Data shows the non-fungible token dominance on Ethereum has rebounded to 22%, suggesting that NFTs may be making a comeback.

According to the latest weekly report from Glassnode, the NFT dominance on Ethereum had dropped to only 13% just a while ago. The “dominance” here is based on the percentage of the total gas usage on the ETH network that a particular transaction type is consuming right now.

When the value of this metric increases for a specific type of token, it means that the token is now making up for a higher part of the total gas consumption on the Ethereum network and is, thus, seeing relatively higher usage from holders than the other transaction types.

As ETH has a very diverse ecosystem thanks to its smart contracts, the network hosts a large variety of transaction types, each corresponding to the different applications built on the blockchain. Some of the most popular such applications include ERC20 tokens, NFTs, bridges, MEV bots, and DeFi.

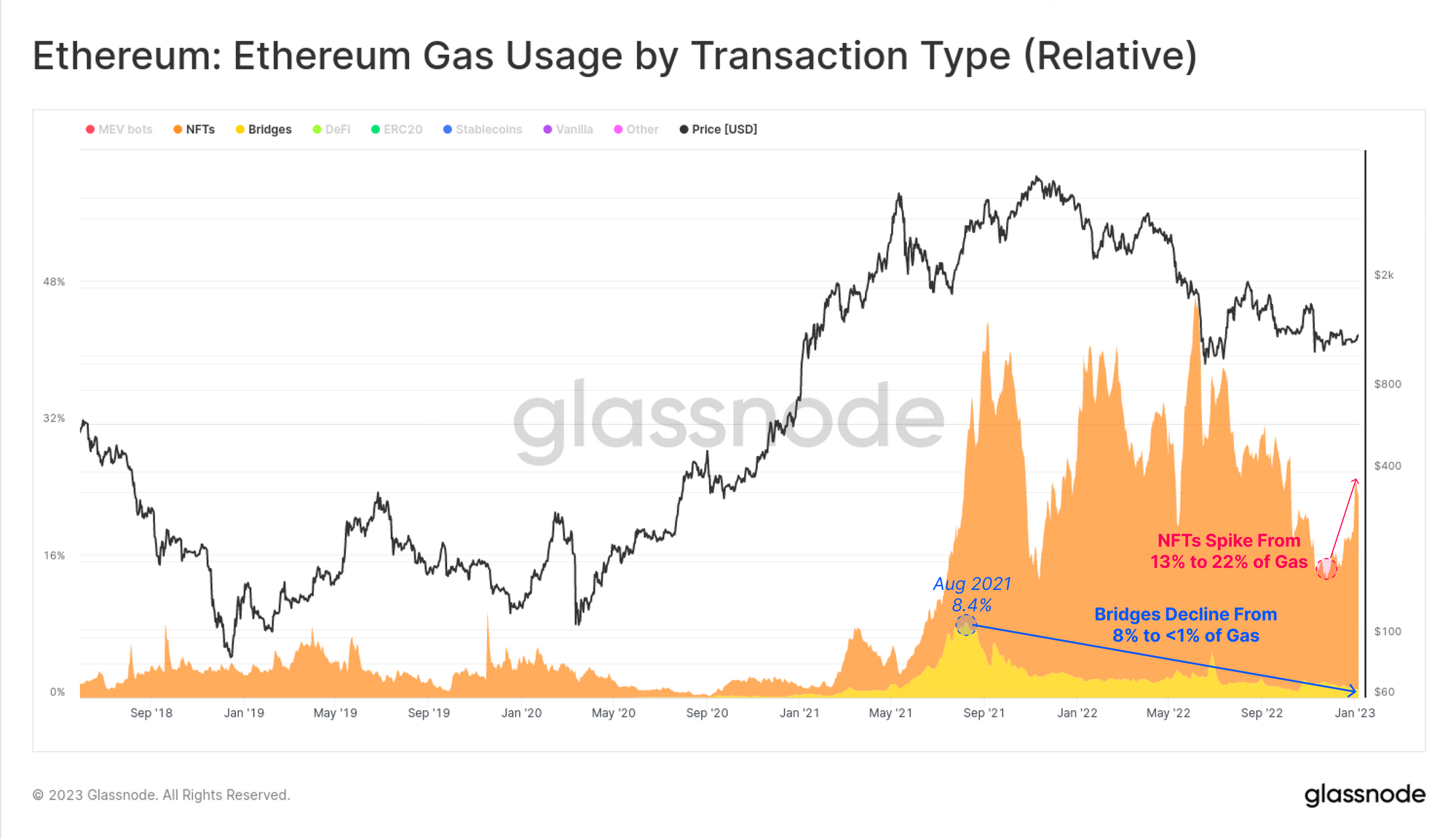

Here is a chart that shows the trend in the dominances for two of these Ethereum transaction types, NFTs and bridges, over the last few years:

As the above graph displays, the NFT dominance on Ethereum had fallen to just 13% not too long ago, after staying at high levels throughout most of 2021 and 2022. This decline meant that the interest in these tokens was fading among investors as not many transactions of this type were taking place. In the last few weeks, however, the gas consumption of NFTs has observed a sharp rebound as their dominance is now at around 22%.

“By and large, the leading NFT markets and projects have maintained a primary foothold on the Ethereum main-chain, and as yet, there has not been a notable migration of existing NFTs towards bridges and other chains,” explains the report.

“Bridges” here refer to applications that connect two blockchains together and facilitate transfers between them. From the chart, it’s apparent that their usage has significantly gone down over the past year-and-a-half, with their dominance going from a peak above 8% in August 2021 to under 1% today.

This decline could be because of the high-profile bridge hacks that took place in the past year. Glassnode notes that the reason NFTs haven’t migrated to bridges and other chains is because of these hacks, as well as the fact that the gas fees have been lower on the Ethereum mainnet recently.

In terms of pure volume numbers across the entire market (that is, including all networks), the NFT weekly average trading volume has almost tripled since the lows in November (as the below chart shows), suggesting that there has been a general renewed interest in these tokens recently.

At the time of writing, Ethereum is trading around $1,300, up 9% in the last week.

For updates and exclusive offers enter your email.

Loves to write, enthusiastic about cryptocurrency. Currently studying Physics at university.

Bitcoin news portal providing breaking news, guides, price analysis about decentralized digital money & blockchain technology.

© 2022 Bitcoinist. All Rights Reserved.