In-game NFTs forecast to grow into $15B market by 2027

Highlighting the Top Regional Aftermarket Research Brokers by Sector Coverage

Next in Tech | Episode 99: Like Vegas, CES is back!

Insight Weekly: PE firms shift strategies; bank earnings kick off; bankruptcies plummet

Tech M&A Outlook: Back on track in 2023?

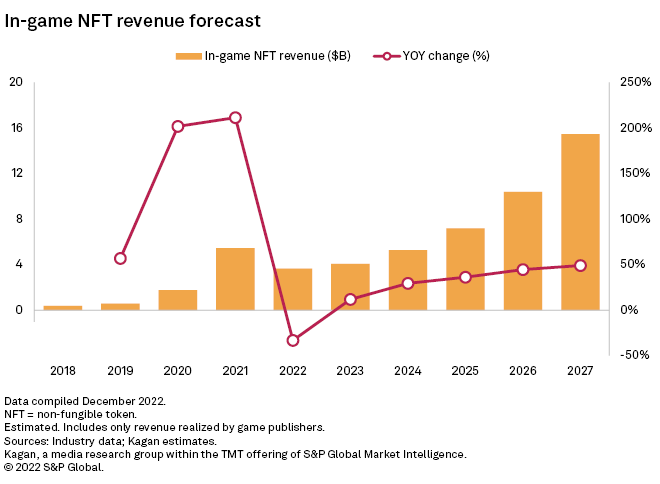

Kagan estimates that publishers made $3.64 billion in revenue from non-fungible tokens connected to items for use inside of video games in 2022, and we expect that figure to grow at a 33.5.% compound annual growth rate through 2027 to $15.46 billion as more games with NFT mechanics come to market and attract a wider player base.![]()

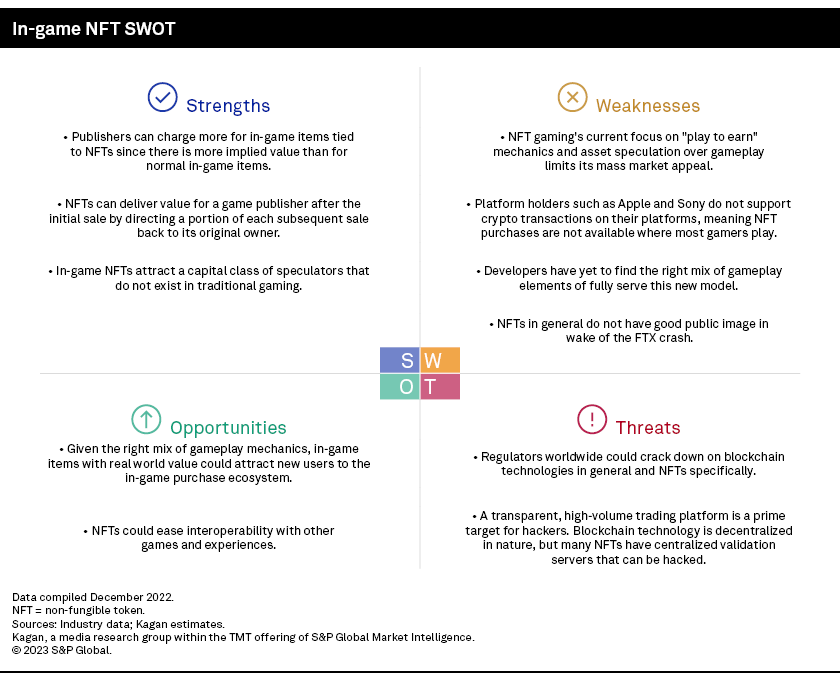

In-game purchases were transformative for the video game industry, and many in the industry believe that giving users the ability to trade and sell those items on the open market through NFTs is the key to unlocking a new level of demand. On the horizon lies the potential for those NFTs to carry virtual items across different gaming experiences and into the metaverse. Developers will have to convince gamers, regulators and platform holders that NFTs are a worthwhile, and safe, investment.![]()

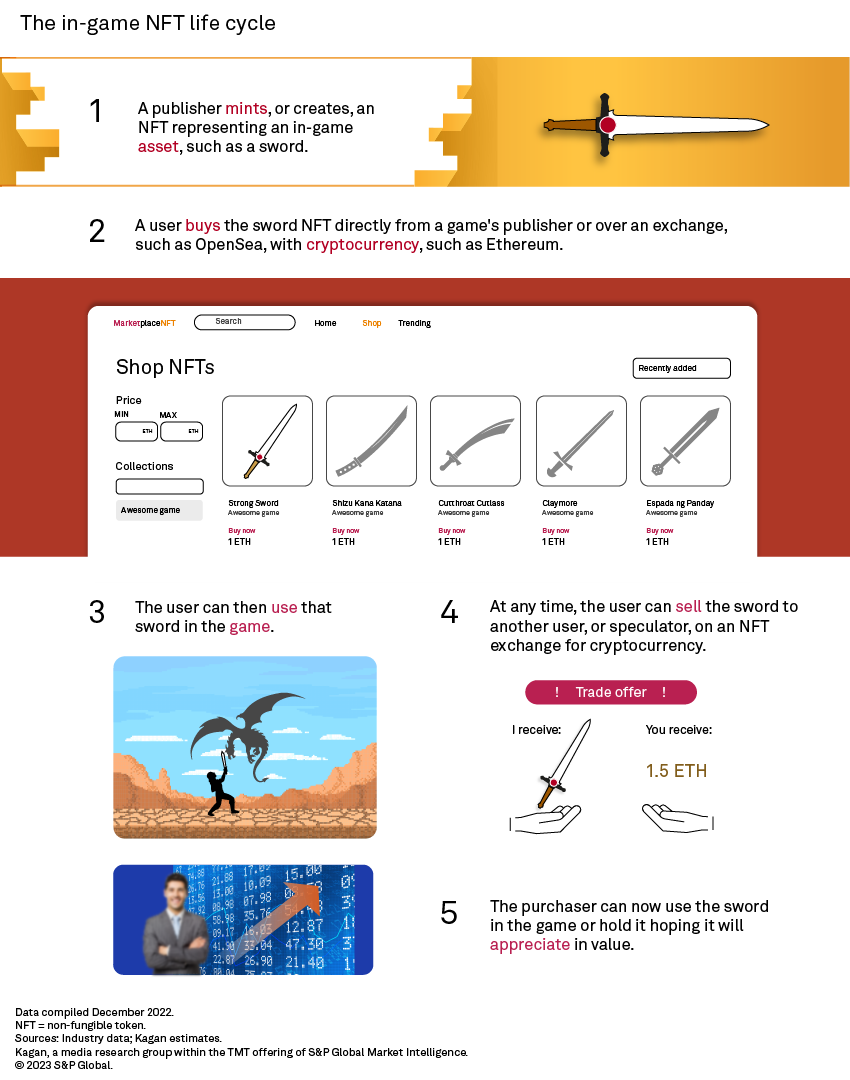

In-game NFTs are digital assets backed by blockchain technologies that authenticate the ownership of in-game items such as weapons, costumes, real estate and avatars. Linking in-game assets with NFTs allows users to trade the item for cryptocurrency via exchanges, such as Ozone Networks Inc.’s OpenSea, which can then be exchanged for fiat currency.

Our analysis of the game market is based on our research into startups in the segment and discussions with prominent industry figures. We have also leveraged our research and data around the broader video game content and in-game purchase markets.

Game publishers make money from NFTs in two ways. The first is the original sale of a newly created, or minted, NFT. The publisher offers the NFT for sale on its website or through an exchange and receives the bulk of the purchase price as revenue (net of payment processing, blockchain transaction and exchange fees).

The second way a publisher makes money is from any subsequent resale of the NFT. Many in-game NFTs include mechanisms that direct a share of any after-market transaction back to the original minting authority.

The biggest game working with NFTs is SKY Mavis PTE. Ltd.’s Axie Infinity. The game asks users to engage in turn-based battles with other players using Pokemon-like Axie monsters. The monsters are tied to NFTs, which need to be purchased from Sky Mavis or from an NFT exchange. The lowest “last sale” price for an Axie monster on OpenSea as of Jan. 13 was 0.0174 ETH, or roughly $25. During the height of Axie’s popularity, some monsters were reportedly selling for hundreds of thousands of dollars.

The winner of the battle gets a “small love potion.” Once the player has a certain number of potions, they can exchange them to create a new monster. The new monster can then be used to win more matches or be sold on the open market.

The game became known for its robust capital class, which drove speculative trading and fueled networks of players farming love potions in employment relationships that resembled pyramid schemes. This meta layer of asset management overshadowed the actual gameplay, which is relatively thin. And the lack of captivating mechanics or story limited the game’s organic player acquisition potential.

Still, the game’s economy grew rapidly through 2021, in part due to the boost the pandemic gave the broader crypto and gaming markets. In February 2022, the company announced it had made nearly $4 billion in lifetime revenue.

But in March 2022, a hack on the company’s servers drained $600 million out of the game’s economy. We see this event and the resulting decline in exuberance around Axie as the key factor behind the market’s decline in 2022.

Other top NFT games in operation include Immutable Pty. Ltd.’s collectable card battler Gods Unchained, Dacoco GmbH’s space miner Alien Worlds, and Dapper Labs Inc.’s cat husbandry simulator Cryptokitties.

This analysis also includes NFT revenue driven by metaverse-like experiences such as Animoca Brands Ltd.’s The Sandbox and Decentraland’s Decentraland, which provide traditional game environments and mechanics in service of socializing and shopping. These games may grow into hubs for the eventual metaverse but are now largely niche curiosities for speculators.

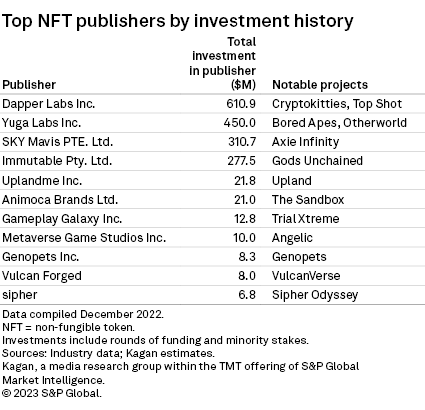

We have identified 30 publishers covered by CapIQ with a strong operational or strategic focus on the in-game NFT segment. Combined, these companies have amassed $1.74 billion in investments since 2018. These funding rounds and minority stakes are supporting refinements, expansions and new projects with a focus on user acquisition.

Note that our analysis includes some companies with operational interests in NFTs that are not strictly related to games. Specifically, Yuga Labs Inc. is best known for its Bored Ape NFT images, and Dapper Labs is known for its partnership with the NBA on Top Shot NFT collectibles.

Potential NFT game releases in 2023 with wider appeal for average gamers include Yuga Labs’ Bored Apes-based game Otherside, ATMTA’s space exploration game Star Atlas, Ember Labs’ survival massively multiplayer online role-playing game The Walking Dead Empires, and sipher’s looter shooter Sipher Odyssey.

Most of these publishers will begin selling NFTs associated with their games as soon as possible, if they have not already started, but the games themselves will arrive in various states of completion with alpha and beta testing stages, limiting the market’s growth potential in the near term.

Over the long term, it becomes increasingly likely that one or more games will find the right gameplay to match the new item ownership model that NFTs convey. We see this move as potentially disruptive in the same way that gaming’s move toward in-game purchases with titles like Supercell Oy’s Clash of Clans and Riot Games Inc.’s League of Legends was in the previous decade.

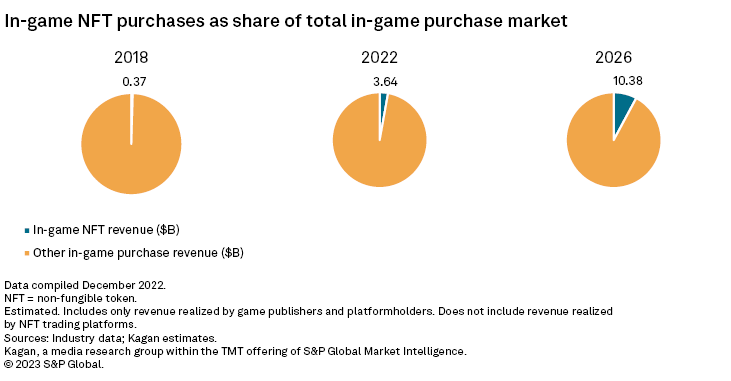

We estimate that as of the end of 2022, NFTs made up roughly 3% of the total in-game purchase market, and we expect it will grow to as much as 8% as of 2026.

Should large publishers or platform holders embrace the market more fully in the next year or two, expect a more dramatic growth curve. If they still have not embraced it by the end of the forecast, expect a more modest growth curve.

The biggest challenge to the NFT market is the reluctance of major platform holders such as Apple Inc. and Sony Group Corp. to engage in crypto-related transactions. This effectively leaves PC gaming as the only substantive market opportunity. By itself, PC gaming made up only 19% of total video game content revenue in 2021.

Some mobile games available on Alphabet Inc.’s Google Play Store and the Apple App Store can be connected via a web browser to an after-market NFT ecosystem where items can be traded and sold, but this two-stroke interface limits players’ engagement with NFT transactions. Examples of this kind of game include NPLUS ENTERTAINMENT Pte. Ltd.’s League of Kingdoms and Animoca Brands’ Benji Bananas.

Publishers hope that the strength of the emerging mechanics and models will force the hands of the larger platform holders to support NFT games, but this line of thinking presents something of a chicken-or-egg conundrum: How will new mechanics gain a foothold if they are not available where consumers game?

We anticipate that any shift in policy among the likes of Sony and Apple would happen cautiously and perhaps only at the behest of an internally developed or sponsored project.

However, we are not aware of any platform holders that have specific plans for the NFT gaming space in the near term. Furthermore, the major publicly traded publishers have largely gone silent on NFT gaming after a handful of ill-fated experiments, such as Ubisoft Entertainment SA tying some weapons in Ghost Recon: Breakpoint to NFTs.

The biggest threat to NFT gaming is regulatory action. Given the perceived risk of cryptocurrencies and the collapse of FTX Trading Ltd., governments around the world will be increasingly wary of letting the average consumer become more exposed to blockchain-related transactions.

We expect some level of regulation to react to the first wave mass market NFT games addressing any particularly predatory mechanics. This would echo the way that paid “loot boxes ” that contained randomized items were regulated in the early days of in-game transactions. Publishers eventually shifted to more transparent “season pass” rewards, though some regulatory overhang persists as evidenced by FTC’s action against Epic Games Inc. in December 2022.

Technology is a regular feature from Kagan, a media research group within S&P Global Market Intelligence’s TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.