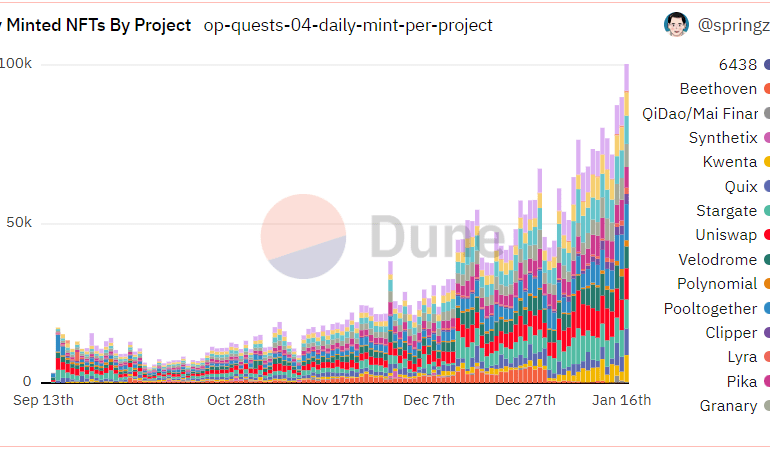

Now that the volume of daily non-fungible token (NFT) sales is at the lowest level since January, many wonder whether the end of the NFT dream is near.

The same question is being asked about cryptocurrencies, and it’s no wonder — the crypto market has taken a beating. Since the Terra debacle, crypto’s total market value had fallen below $1 trillion for the first time since January 2021.

With an outlook so bleak, claiming that NFTs are just a fad is a reminder of traditional financial analysts‘ claims that bitcoin’s BTCUSD, -0.67% death is “just around the corner.” Since its inception, at least 461 such “obituaries” have been written, with many more to follow as markets soar and plummet during bear and bull cycles.

So what’s the real situation with the NFTs? In short, they’ve reached a maturation threshold.

The initial hype and unsustainable growth were fueled by profile-picture NFTs, which were popularized by Bored Apes and Crypto Punks. They were interesting to investors, traders and collectors alike due to their insane valuation and surge in pricing. However, as it happens in economic downturns and bear markets, investors realized that putting their money elsewhere was a better option.

The decline in daily sales volume was a clear signal that things needed to change. And change they have. NFTs and their marketplaces have matured and proliferated; NFTs in particular went through a gradual, yet substantial, change by becoming more than a collectors item or a piece of art.

A good example of this evolution is what Ted Leonsis, the owner of Washington Wizards NBA team, has in store for the existing Top Shot series.

You can buy NBA NFTs featuring highlights from plays and players, but Leonsis plans to expand the usefulness of these digital collectibles by providing the owners with tickets to upcoming games. For example, you can not only buy a memento commemorating the greatest moments of your favorite team, but also get a seat for the next game.

This approach is known as token gating: Using an NFT token to provide owners with access to an exclusive set of benefits, be it a product, discount or service.

NFTs are smart contracts aimed at proving ownership, but due to their flexibility and programmability, they can be automated and customized for different uses. Another common feature of NFTs is to assign royalties to the issuer every time the NFT changes hands.

In our previous example, maybe the owner wanted to trade the NFT after watching the game or he bought it in hopes of selling it at the last minute to desperate fans who want to go to the game? The NBA, the issuer of the ticket, would earn a portion of revenue whenever the NFT changed hands.

And it’s not only retail — governments are also embracing the technology.

According to an article from Yahoo Finance, “The High Court of England and Wales has allowed Fabrizio D’Aloia, the founder of Italy-based online gambling company Microgame, to file a lawsuit against anonymous people through a non-fungible token (NFT) drop.”

The importance of this ruling is best highlighted by Joanna Bailey, an associate lawyer from Giambrone & Partners LLP who worked on the case:

“This is so important because it shows the court’s willingness to adapt to new technologies and embrace the blockchain and actually step in to help consumers where previous legislation and regulators simply could not do that.” (From CoinDesk.)

A similar move was made by a U.S. court in June.

These methods of informing potential lawsuit participants are useful in scenarios where an individual’s whereabouts are unknown and only a digital wallet related to the lawsuit in question exists.

As you can see, NFTs are evolving and slowly becoming an integral part of the so-called fiat world. While current market conditions are bearish and might present a challenge for the industry, these technologies are here to stay. If you’re worried about the future of NFTs, don’t be. The industry is just getting started.

P.S.

To put money where my mouth is, I’ve decided to test the waters and start a token-gating project of my own. In one of my upcoming articles, I will tell you all about it — challenges, adoption, results and my clients’ testimony. I believe it will be an interesting read and an indication of just how easy, or difficult, it is to implement NFT technologies in the real world.

Tesla reported adjusted second-quarter earnings per share of $2.27 from $16.9 billion in sales, better than Wall Street expected.

Jurica Dujmovic is a columnist for MarketWatch. He is a business publisher, consultant, designer and gamer. Follow him on Twitter @JuricaDujmovic.

Visit a quote page and your recently viewed tickers will be displayed here.