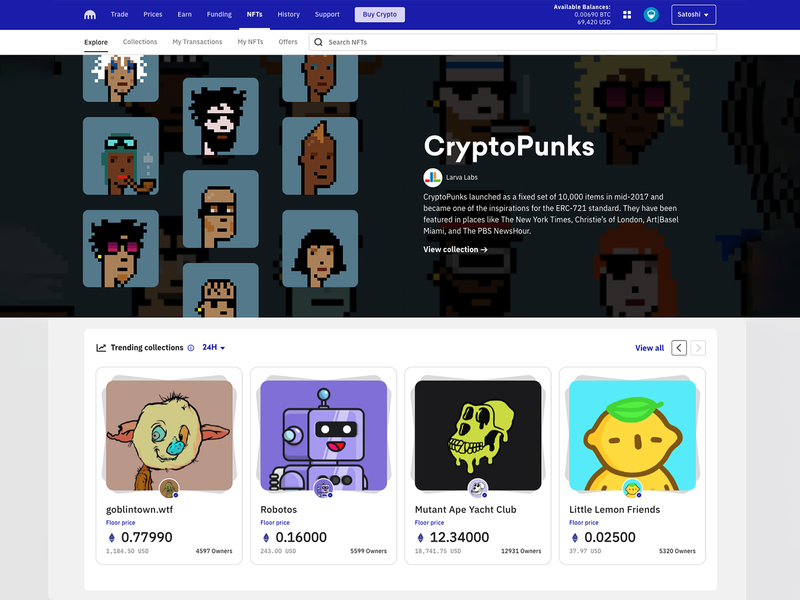

Cryptocurrency exchange Kraken has launched the beta version of its platform for its non-fungible token (NFT) marketplace, which offers "gasless" transactions and an intuitive design. Currently the marketplace is only open to customers who joined the waitlist in May, 2022.

Kraken NFT touts itself as "the complete solution for exploring, curating and securing your NFT collection." The launch includes a curated offering of 70 top-selling NFTs on the Ethereum and Solana blockchains.

According to the site, transactions will be "gasless," meaning that users can buy and sell NFTs that are custodied within the Kraken ecosystem without incurring blockchain network fees. "This means clients can trade on the marketplace with zero disruption, even in peak network activity," Kraken said in a press release.

The new marketplace will also feature an NFT aggregator, which allows users to view and purchase NFTs listed on other marketplaces; "creator rewards" paid back to original content creators after each secondary market sale so that they are "always properly compensated for their time and efforts;" rarity scores for all supported NFT collections; and the option to trade NFTs using over 200 cryptocurrencies and eight fiat currencies.

As more NFT marketplaces shift toward optional royalty models, Kraken told CoinDesk that it is "committed to creating an environment that is balanced and fair to both creators and collectors."

"As of today, we collect royalties on behalf of creators and distribute them once a collection's creator has been verified. The exact percentage varies by collection. However, our thinking on this may – and should – evolve as solutions that better serve the NFT community are developed."

Kraken said that it plans to open up the beta to the public "soon after" launching its initial beta test with waitlist signees. It added that its decision to launch an NFT marketplace highlights its belief that NFTs are "more than a speculative asset."

"Our focus is to ensure clients experience a premium and secure service; we're not in the business of timing markets, but in accelerating financial freedom and independence," Kraken told CoinDesk.

Kraken joins a growing number of NFT marketplaces that are integrating new tools like aggregators and rarity trackers onto their platforms to remain competitive. Last month, Rarible launched its Rarible 2 update, which incorporated new aggregation tools, while Paradigm-backed NFT marketplace Blur launched with "professional" trading features like “floor sweeping” across multiple marketplaces, reveal “sniping” and portfolio analytics tools.

UPDATE (Nov. 3, 17:40 UTC): Updates headline and details throughout to reflect Kraken's NFT marketplace has launched to those who were on the waitlist as of today.

Related Quotes

(Bloomberg) — JPMorgan Asset Management’s Japan equity fund is betting on undervalued industrial-related shares to shine amid a potential market rally driven by a weakening yen, rising capital expenditures and improving corporate earnings.Most Read from BloombergBinance’s Zhao Flags Possible $1 Billion for Distressed AssetsMalaysia PM Anwar Plans Confidence Vote to Prove to Rival He Commands a MajorityElizabeth Holmes Judge Proposes Texas Prison, Family VisitsChina Covid Cases Jump to Record Hi

Smart Beta ETF report for DGRW

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Avis Budget Group is IBD Stock Of The Day as CAR stock trades in a tight range near a buy point after a huge Q3 earnings beat.

Dexcom and other top stocks to watch this week combine strong technicals with generally solid fundamentals.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Valero Energy (VLO) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Smart Beta ETF report for FXR

EQT Corporation (EQT) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

AbbVie's (ABBV) Skyrizi becomes the first specific IL-23 inhibitor to get approval for Crohn's disease in the European Union.

ABU DHABI (Reuters) -International Holding Company plans to sell 20% of its technology unit in an initial public offering next year, its CEO told Reuters, adding that the UAE's IHC is aiming for a first quarter IPO of Pure Health to raise more than $1 billion. IHC, which rose from relative obscurity to become the United Arab Emirates' largest publicly traded company worth more than $200 billion, has been on a consolidation and acquisition drive. This has led to two IHC subsidiaries rounding out the three biggest companies on the Abu Dhabi Securities Exchange (ADX).

PCAR vs. TSLA: Which Stock Is the Better Value Option?

Cimpress (CMPR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Pilgrim's Pride (PPC) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

(Bloomberg) — Historic turmoil in cryptocurrency markets sparked by FTX’s implosion hasn’t stopped one funds issuer from moving forward on a new investment product tied to Bitcoin. Most Read from BloombergTiantian Kullander, Co-Founder of Crypto Firm Amber, Dies at 30A Rival’s Misstep Helped Anwar Finally Land Malaysia’s Top JobAdobe Sees Up to $9.2 Billion in E-Commerce: Black Friday UpdateUS Bans Huawei, ZTE Telecom Equipment on Data-Security RiskUS Shoppers Kick Off Holiday Season With a Mut

Joyy's (YY) third-quarter top-line growth is expected to have been hit by macroeconomic headwinds including high inflation, and increased interest rates.

Artivion (AORT) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Antero Resources (AR) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

Tesla was painted as a China Play, and with China slowing so much that its Central Bank is throwing open the monetary spigot, look for Elon to to focus his energies elsewhere.