by Sarah Butcher 2 minutes ago

The volume of NFTs trading on OpenSea may have plummeted, but senior traders from investment banks still see a future in the tokens. Two former traders at Credit Suisse in New York have reappeared with an NFT venture of their own.

Bankole Omodunbi and Justin Bojarski spent eight and fifteen years at Credit Suisse respectively. Omodunbi was an MD in equities quant trading and head of principal trading products before he left in 2021. Bojarski was a director in delta one trading and left earlier this year. Both have a background in computer science, and have spent the time since they left banking writing the code for a new API platform (Verbwire) that allows people who aren’t proficient in coding smart contracts to access seven different blockchains.

“In the past, you had to learn Solidity to deploy a smart contract on the Ethereum network,” says Omodunbi. “But with our API that’s not necessary. Solidity is there behind the scenes, but as a developer you can work in Java, Python, C# or C++ and use Verbwire instead.”

Verbwire has the potential to solve a major stumbling block in the evolution of the Blockchain economy – the perennial shortage of Solidity developers. While they’re not quite as hard to find as they used to be, Omodunbi says really good Solidity developers remain a rarity. By comparison, he says, “there’s a ton of people” on Wall Street and in big tech who know web 2.0 languages like Python and Java. “Verbwire makes it possible for them to write and deploy their own contracts on the blockchain.”

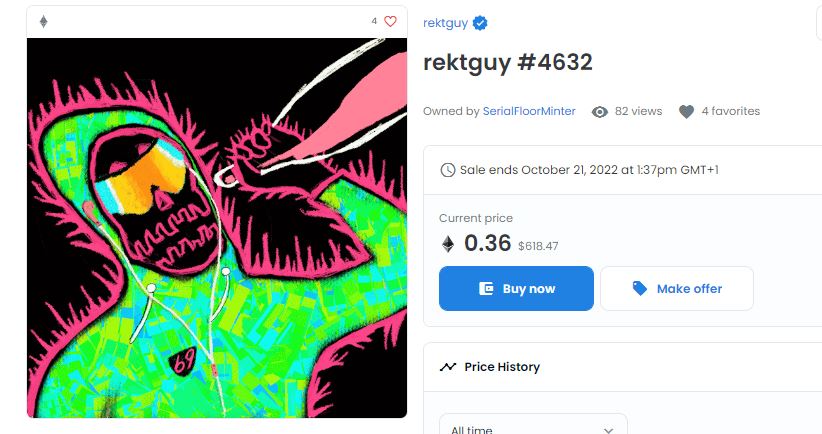

Omodunbi doesn’t buy into the notion that NFTs are in perennial decline. On the contrary, he says the technology has barely got started. “JPEGS are not the long term use-case. They’re just scratching the surface – smart contracts can be used for everything from real estate to concert tickets, to loyalty cards. Anything where you have an enforced agreement of some sort is a potential use case for the blockchain.”

Nor does Omodunbi have any regrets about leaving Credit Suisse’s trading business. He says his exit wasn’t motivated by issues at the Swiss bank but by the fact that he wanted to be more innovative than was possible in a large regulated organization. “It wasn’t a Credit Suisse thing. There are a lot of layers in a bank and making a small change takes weeks and months. Everything moves much faster in the blockchain world.”

“I’m an engineer and I like solving problems,” says Omodunbi. “In banking, I was building algorithms and writing code to generate pnl. Now, I’m writing code to facilitate the advancement of Web 3.0.”

Click here to create a profile on eFinancialCareers. Make yourself visible to recruiters hiring for top jobs in technology and finance.

Have a confidential story, tip, or comment you’d like to share? Contact: sbutcher@efinancialcareers.com in the first instance. Whatsapp/Signal/Telegram also available (Telegram: @SarahButcher)

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.)

Get the latest career advice and insight from eFinancialCareers straight to your inbox

Please click the verification link in your email to activate your newsletter subscription

Click here to manage your subscriptions

eFinancialCareers

© 2022. All rights reserved.