SIGN-UP FOR RETAILWIRE NEWSLETTERS! DON’T MISS OUT!

The new Toys “R” Us has been making more innovative, on-trend moves than it did before its most recent relaunch and that now extends to getting involved in Web 3.0.

The toy retailer is launching a 10,000 item collection of non-fungible tokens (NFTs) available on a blockchain called Solana and purchasable through a marketplace called Magic Eden, according to a press release.

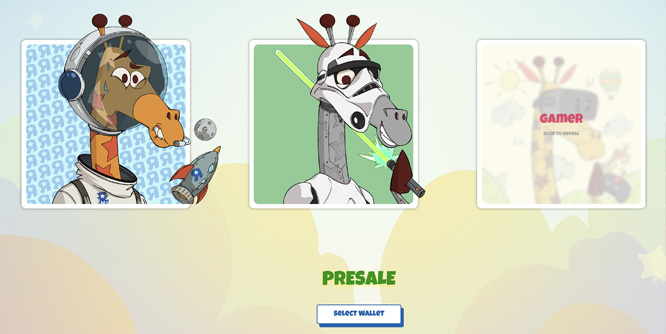

The NFTs, made in conjunction with Web 3.0 company Anybodies, consist of 3-D animations of Toys “R” Us mascot Geoffrey the Giraffe inspired by toys available in-store. People who buy the NFTs will be able to earn “GCoins” to redeem for access to exclusive toys and in-store events, VIP admission to flagship openings and early access to new releases, with more associated loyalty rewards and discounts in the offing.

While NFTs grew in popularity late in 2021, more recent reports are showing that collectors are skeptical of the long-term value of the digital assets.

In the third quarter of 2022, NFT sales were down to $3.4 billion, having peaked at $12.5 billion in the first quarter of 2022, according to a Reuters article. In the traditional art collecting market, where big money was being thrown around at NFTs early on, sales through major auction houses plunged from 127 million British pounds in 2021 to 8.4 million this year.

Toys “R” Us is not the only retailer experimenting with rolling NFTs into a loyalty program.

Starbucks earlier this year announced its revamped Starbucks Odyssey loyalty program, which it has just opened to beta testers, according to TechCrunch. The program allows users to earn NFTs called “Journey Stamps” by carrying out particular activities in-store or on the app. Customers who have collected requisite amounts are able to redeem them for online and real-life experiences.

Brands have succeeded in turning a profit on NFTs, as well. For instance Nike, which acquired an NFT creation studio late in 2021, had by August of this year made $185.3 million from selling NFTs, according to Input.

DISCUSSION QUESTIONS: Is launching a line of NFTs a good idea for Toys “R” Us? Have digital collectibles lost their steam or can brands still profit from them?

11 Comments on “Is Toys ‘R’ Us just playing around with NFTs or serious about the opportunity?”

You must be logged in to post a comment.

You must be logged in to post a comment.

There is a nostalgia mentality for many people of the age who are now exploring NFTs — younger Millennials (Zillennials). With the being Toys “R” Us’s come-back, it’s interesting to explore modern offerings and reengage former customers through NFTs.

I see this as a peripheral move. NFTs are popular among some, but they are not a savior for any ailing business. I also think that some of the heat is now going out of the NFT market as consumers become more constrained and start to question the real value of NFTs. I think Toys “R” Us could do something interesting in the metaverse, such as building a fully interactive world and experience aimed at kids and young people, but that needs a much broader vision than just focusing on NFTs.

Personally, I don’t get it. It sounds a lot like the Beanie Baby phenomenon.

A good marketer always keeps a toe in the water with several experiments, and certainly the NFT play is a prime example of this. Will this succeed for Toys “R” Us? Likely not. I’d prefer to see them develop an immersive metaverse game that caters to kids and young parents, with a strong family theme so the entire family can engage. There is more return with this type of innovation than with digital collectibles. There is significant risk with any form of digital currency (just ask SBF), and although Nike may be able to reap a reward from NFTs, Toys “R” Us is not the brand Nike is.

You want to be a retailer? Be a retailer and sell “stuff” that kids can play with. Do you want to be a bank or a suspect financial instrument purveyor? Then don’t be a retailer.

This is the perfect venue for NFTs as it aligns with the digital world that our youngest shoppers have been born into. If the parents don’t know how to use the NFT, their kids would be more than happy to teach them.

This concerns me. If the company is already feeling it needs to pull unrealistic and extreme gimmicks out in order to make their business work, sounds to me like something is already badly wrong.

The events of the past few weeks give the impression that much of the activity around crypto and NFTs is just plain criminal theft and money laundering. There are far simpler ways to build engagement and loyalty through store experience and purchases, especially when we’re talking about games and toys. I’m skeptical the “new” Toys “R” Us was really ever about being a great toy store and more about a money grab.

Great point. I hadn’t even figured in the absurdity of “Parents! You thought the claw machine was bad? Now you can introduce your children to the scam of the new century … at Toys-R-Us!”

That’s really going to help make T-r-U strong.

Whenever I read about a depressed or failing company diving into a sketchy endeavor (e.g. Overstock.com’s brilliant diamond move), I can’t help but wonder if they are an ongoing retail operation or an investor-purchased boondoggle. This is so far away from their supposed core competency and something only a fringe of society might get behind.

You can be, as Toys “R” Us is in this case, on trend without being on point. Sure, NFTs are “trendy” — albeit in a declining trend sort of way — but I’m not too bullish on the future of mass marketed retail digital collectibles. Toys “R” Us has more important problems to address.

How likely are at least five large retail chains to add NFTs to their loyalty program offerings in 2023?