Search

Bored Ape Yacht Club hype was in full swing earlier this year as celebrities “aped into” the pricey Ethereum NFT collection. Some have even used their Apes to create products, themed restaurants, live performances, and more.

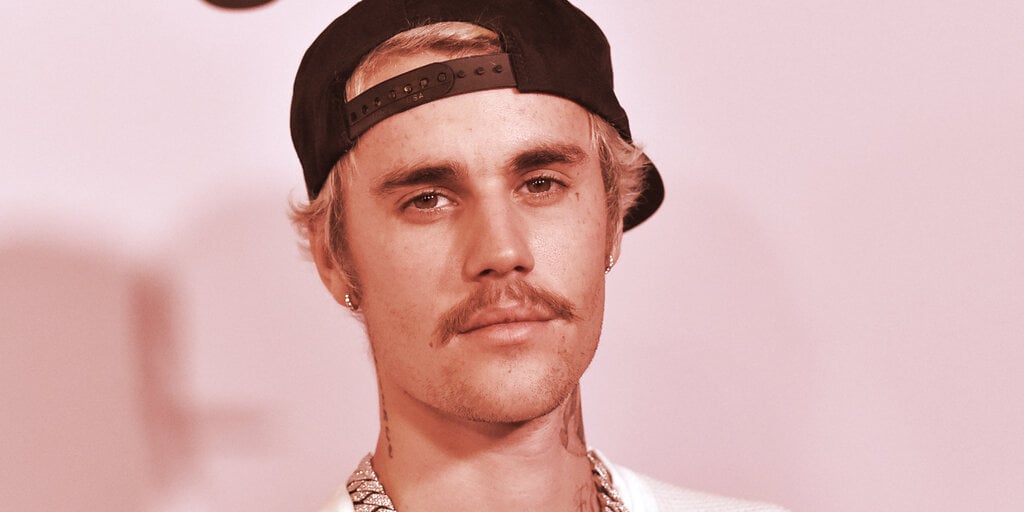

But the buzz has faded amid the crypto bear market, and the price to join the exclusive club has been dropping lower and lower in recent weeks. And a “floor” Bored Ape, like the one that singer Justin Bieber spent $1.3 million worth of ETH to buy in January, now sells for a tiny fraction of that price point.

As of this writing, the floor price for the Bored Ape Yacht Club—that is, the price of the cheapest-available NFT listed on a marketplace—is about 58.2 ETH, per data from NFT Price Floor, or about $69,800. On Monday, the floor price dipped below $60,000 for the second time this month, but it ticked back upwards throughout the day on Tuesday.

It’s been a rough November for the Bored Apes, as the floor price in USD has fallen 33% since the start of the month. Last week’s collapse of popular crypto exchange FTX had an apparent impact on the NFT market, driving down crypto prices and impacting NFT valuations as well, but other notable projects aren’t taking as hard of hits as the Apes.

CryptoPunks, another “blue chip” NFT project owned by Yuga Labs, has seen its floor price drop by 23% this month to about $79,800 (66.5 ETH) in November. Its price in ETH today is nearly identical to what it was on November 1; what’s changed is the USD value of ETH. The Bored Ape floor, on the other hand, has dropped from 66.6 ETH to 58.2 ETH, and fell as low as 48 ETH on Tuesday morning.

The Bored Ape floor peaked at about $429,000 (152 ETH) in late April, ahead of the crypto market crash, due to hype around the debut of NFT land plots for Yuga’s Otherside metaverse game. Bored Ape owners had just cashed in on the March launch of ApeCoin and were set to receive free Otherside land, making the NFTs look like gifts that kept on giving.

But the crypto crash led to rapidly diminishing speculative frenzy around NFTs, and that has driven Bored Ape prices down significantly over the past six months. The entry price for a Bored Ape today is about 84% less than it was at the April peak, as measured in USD.

An NFT is a blockchain token that represents ownership in an item, including unique profile pictures (PFPs) like the Bored Ape Yacht Club. The project’s 10,000 NFT avatars grant users access to a private community and events, as well as exclusive merchandise, potential future NFT and token drops, and the ability to commercialize their owned NFT artwork.

Amid the decline, we’ve seen no major recent examples of celebrities flooding into the project, following a barrage of buys in late 2021 and early 2022 that brought folks like Jimmy Fallon, Steph Curry, Madonna, Eminem, Gwyneth Paltrow, and Snoop Dogg into the club.

The price drop has also made some of the seven-figure Bored Ape purchases stand out even more in hindsight. One notable example is musician Justin Bieber’s January purchase of an Ape for $1.3 million (500 ETH)—a pickup that was deemed questionable at the time by crypto influencers who said that he overpaid for an Ape with very common traits.

Next time you think you’re down bad, just remember that .@justinbieber just bought a floor ape for 500 ETH.

— gmoney.eth (@gmoneyNFT) January 29, 2022

“Who [the fuck] is advising Justin Bieber’s NFT purchases,” tweeted Rug Radio co-founder and host Farokh Sarmad, “and how can I get in touch to sell them [floor] NFTs for 500 ETH?”

It’s ranked the 9,810th most rare Bored Ape based on its traits and features, per Rarity Tools, meaning it’d probably sell for floor price if not tied to a world-famous celebrity.

A similar Ape might sell for nearly one-ninth of that price in ETH today, or almost 1/19th of the price in USD. Bieber’s purchase may have marked the top of the celebrity Bored Ape boom, even as holders like Eminem and Snoop Dogg have continued to use their Apes prominently since.

The falling prices appear to be juicing sales, however: some $6.5 million worth of Apes were sold Tuesday, per data from CryptoSlam—a 135% increase from the previous day's sales.

This has been pretty common on days post BendDAO-overflow.

BendDAO concerns pummel the floor well below the level people are calibrated to, and then when people realize there's buying interest they rush to buy.

Also I think Blur 0-fee, 0-royalty creating a lot more flips.

— NFTstatistics.eth (@punk9059) November 16, 2022

Pseudonymous crypto analyst Punk9059, director of research for NFT startup Proof, tweeted that the Bored Ape floor price tends to fall as owners get concerned about NFT liquidations from BendDAO, an NFT lending service, but then sales rise and floor price recovers as people buy up the NFTs.

They also cited the impact of recently launched NFT marketplace Blur, which is targeted at "pro traders" and doesn't charge a marketplace fee or enforce creator royalty fees. Punk9059 suggested that such an environment "[creates] a lot more flips" from Bored Ape traders.