© 2022 dot.LA. All rights reserved

Get in the KNOW

on LA Startups & Tech

Samson Amore is a reporter for dot.LA. He previously covered technology and entertainment for TheWrap and reported on the SoCal startup scene for the Los Angeles Business Journal. Send tips or pitches to samsonamore@dot.la and find him on Twitter at @Samsonamore. Pronouns: he/him

The “crypto winter” might be rolling in, but the founders of Food Fighters Universe are staring the storm in the face and boldly claiming now is actually the time to double down on digital assets.

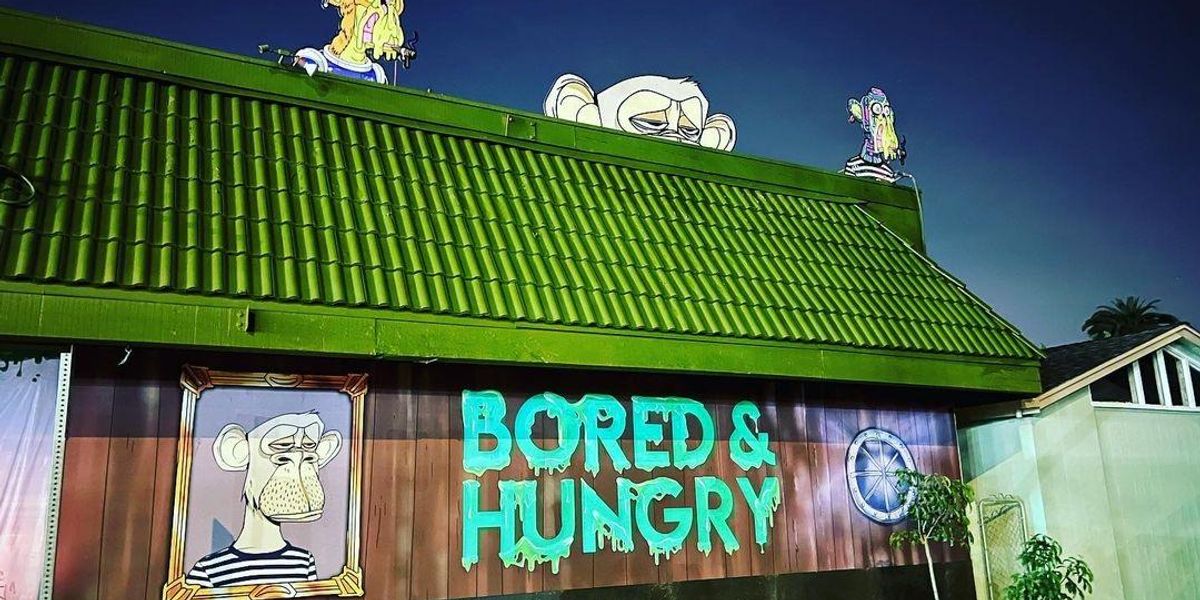

Food Fighters Universe, which bills itself as the first NFT-themed restaurant group, was started just four months ago by co-founders Andy Nguyen, COO Phillip Huynh and “chief megaphone” Kevin Seo.

The restaurant does still accept crypto, despite a recent Los Angeles Times article where a reporter described visiting the site and said staff weren’t accepting Ethereum or ApeCoin, the cryptocurrency linked to Bored Apes. Nguyen and Seo told dot.LA the reporter just happened to visit the store when their systems were temporarily down for maintenance, and said they’re still taking crypto as payment.

“It was timing and miscommunication,” Seo claimed. “[The LA Times] happened to stop by when we were in NYC doing an activation with Bored & Hungry and we were accepting crypto payments in New York and there was a technical issue on the west coast we were unaware of.”

“The best time to accept crypto is in a bear market, that’s when you make your most money,” said Nguyen, a restaurateur known best for his involvement in Los Angeles’ Afters Ice Cream chain.

Seo told dot.LA the restaurant plans to accept more forms of crypto as payment in coming months. And though the co-founders wouldn’t disclose the restaurant’s revenue, Seo noted they had plans to open a second Bored & Hungry location in Seoul, South Korea this fall—the store’s first international expansion.

It’s important to note that accepting crypto isn’t the only thing that makes Bored & Hungry a web3-adjacent enterprise: the restaurant’s theme is based around Bored Ape Yacht Club, the controversial NFT collection from Yuga Labs.

Celebrities like Paris Hilton, Jimmy Fallon, Tom Brady and Seth Green have openly endorsed the apes, while critics (like web designer and Azaelia Banks’ ex-boyfriendRyder Ripps) claim the project is rooted in racism or Nazi iconography – something Yuga Labs CEO Nicole Muniz strongly denies.

“I think it's just he said, she said, people digging,” Nguyen said when asked about the allegations. “[Bored Ape] is the most popular brand out there, it is what it is.”

In creating the restaurant, Nguyen had to meet the Bored Ape founders and spoke with one of them (he didn’t say which one) to get their official endorsement, and added, “he didn’t seem crazy.”

Despite the unsavory accusations and impending crypto crash, the series of 1,000 humanoid ape cartoons is quite possibly the most popular NFT brand out there, with sales surpassing $1 billion earlier this year. That’s why Nguyen and his team chose to purchase three Bored Ape NFTs earlier this year for roughly $330,000 and theme their Long Beach hamburger joint around them.

The price floor for Bored Ape Yacht Club’s NFTs continues to fluctuate. After peaking at a high of roughly 149 Ethereum in early May, the project is now down to 81.75 ETH. Decrypt reported in June the collection dropped 47%, falling below a $100,000 floor price for the first time since August 2021.

Nguyen said the desire to link with the Bored Ape brand was rooted in its widespread appeal.

“We are going to be gunning for the top 10 [most] popular coins out there,” Seo told dot.LA, while acknowledging the percentage of people actually purchasing their lunch with crypto is still miniscule.

“Adoption is still going to take a long time,” Seo said. “We're going to continue to push it, even though it's being used very minimally. It's not a huge percentage of anything. Some folks want to do it and just having the option feels good, and we hope that that will lead to more adoption.”

Samson Amore is a reporter for dot.LA. He previously covered technology and entertainment for TheWrap and reported on the SoCal startup scene for the Los Angeles Business Journal. Send tips or pitches to samsonamore@dot.la and find him on Twitter at @Samsonamore. Pronouns: he/him

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

When avatar startup Genies raised $150 million in April, the company released an unusual message to the public: “Farewell.”

The Marina del Rey-based unicorn, which makes cartoon-like avatars for celebrities and aims to “build an avatar for every single person on Earth,” didn’t go under. Rather, Genies announced it would stay quiet for a while to focus on building avatar-creation products.

Genies representatives told dot.LA that the firm is now seeking more creators to try its creation tools for 3D avatars, digital fashion items and virtual experiences. On Thursday, the startup launched a three-week program called DIY Collective, which will mentor and financially support up-and-coming creatives.

Similar programs are common in the startup world and in the creator economy. For example, social media companies can use accelerator programs not only to support rising stars but to lure those creators—and their audiences—to the company’s platforms. Genies believes avatars will be a crucial part of the internet’s future and is similarly using its program to encourage creators to launch brands using Genies’ platform.

“I think us being able to work hands on with this next era—this next generation of designers and entrepreneurs—not only gets us a chance to understand how people want to use our platform and tools, but also allows us to nurture those types of creators that are going to exist and continue to build within our ecosystem,” said Allison Sturges, Genies’ head of strategic partnerships.

DIY Collective’s initial cohort will include roughly 15 people, Sturges said. They will spend three weeks at the Genies headquarters, participating in workshops and hearing from CEOs, fashion designers, tattoo artists and speakers from other industries, she added. Genies will provide creatives with funding to build brands and audiences, though Sturges declined to share how much. By the end of the program, participants will be able to sell digital goods through the company’s NFT marketplace, The Warehouse. There, people can buy, sell and trade avatar creations, such as wearable items.

Genies will accept applications for the debut program until Aug. 1. It will kick off on Aug. 8, and previous experience in digital fashion and 3D art development is not required.

Sturges said that the program will teach people “about the tools and capabilities that they will have” through Genies’ platform, as well as “how to think about building their own avatar ecosystem brands and even their own audience.”

Founded in 2017, Genies established itself by making avatars for celebrities from Rihanna to Russell Westbrook, who have used the online lookalikes for social media and sponsorship opportunities. The 150-person company, which has raised at least $250 million to date, has secured partnerships with Universal Music Group and Warner Music Group to make avatars for each music label’s entire roster of artists. Former Disney boss Bob Iger joined the company’s board in March.

The company wants to extend avatars to everyone else. Avatars—digital figures that represent an individual—may be the way people interact with each other in the 3D virtual worlds of the metaverse, the much-hyped iteration of the internet where users may one day work, shop and socialize. A company spokesperson previously told dot.LA that Genies has been beta testing avatar creator tools with invite-only users and gives creators “full ownership and commercialization rights” over their creations collecting a 5% transaction fee each time an avatar NFT is sold.

“It's an opportunity for people to build their most expressive and authentic self within this digital era,” Sturges said of avatars.

The company’s call for creators could be a sign that Genies is close to rolling out the Warehouse and its tools publicly. Asked what these avatar tools might look like, the startup went somewhat quiet again.

Allison Sturges said, “I think that's probably something that I'll hold off on sharing. We will be rolling some of this out soon.”

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

Between 2020 and 2021, a cryptocurrency boom led several crypto-oriented companies to ink deals with athletic organizations like the NBA and UFC. One of the bigger deals was blockchain giant Crypto.com signing a $700 million deal with the Staples Center—one of the world's largest sports and entertainment venues—in Los Angeles. The Singapore-based company also signed agreements with the UFC and Formula 1 for promotion at various sports venues and on athletic equipment.

Crypto.com wasn't the only crypto company to extend its reach into sports or entertainment. In exchange for naming rights to the Miami Heat's arena for 19 years, FTX, a cryptocurrency derivatives exchange, paid $135 million. And in an exclusive deal, Coinbase became the exclusive cryptocurrency exchange for the WNBA, NBA, and NBA G League.

Rolling into 2022, there was little warning that crypto winter was coming.

In May, the major stablecoin TerraUSD lost its peg to the US dollar. In one day alone, TerraUSD lost $60 billion in value. After that, major crypto lender Celsius suspended withdrawals, citing liquidity problems. The company followed up by filing for bankruptcy.

They were just among the first dominos to topple in the crypto world, and many others soon fell. As a National Research Group (NRG) report about the state of the cryptocurrency industry noted, the market has gone "down over 70% from the highs it reached towards the end of 2021, and many of the most popular coins are trading at less than half of where they were at the beginning of the year."

As the NRG report also notes, the crypto market has undergone "dramatic" corrections before. Is the current crypto winter that different? And more importantly, will crypto winter freeze the budding love affair between entertainment, pro sports, and cryptocurrency?

According to NRG, "crypto winter" has affected the public view of cryptocurrency in various ways.

For example, NRG reports that "70% of consumers feel they have at least a 'moderate' understanding of cryptocurrencies." If accurate, that’s a notable change from a YouGov survey conducted in June 2021 which found that 69% of Americans agreed with the statement, “I don’t really understand cryptocurrency.”

On the other hand, at least 61% of people surveyed said they were aware of the "crypto crash" or "crypto winter." It seems the heavy and negative news coverage of crypto winter over the last three months has considerably boosted consumer awareness—of the crashing market.

NRG notes, "This isn't a technological novelty anymore; increasingly, having some knowledge of crypto and how it works is seen as an element of baseline financial literacy."

Even though consumers have been exposed to a large number of crypto news stories, however, NRG reports that few bother to do deeper research. Bitcoin remains the most well-known name, and consumer awareness of other coins like ETH, Dogecoin, or even popular meme coin Shiba Inu hasn't increased much since the beginning of 2022. Even with the media's attention to TerraUSD de-pegging from the dollar (arguably one of crypto's most significant events in recent memory), only 7% of consumers are familiar with the term "stablecoin."

Crypto.com’s Al D’Agostino gave a succinct response to dot.LA when we reached out for further comment on the company's association with the Staples Center: "Crypto.com remains fully committed to its sports sponsorships. We are well financed and these are multiyear contracts, which will continue to play a crucial role in our mission to accelerate the world's transition to cryptocurrency."

While the New York Post reported in late June that FTX had backed out of sponsorship negotiations with the Los Angeles Angels, the crypto exchange has taken on new sponsorship obligations with a $210 million naming deal for pro esports team TSM, aka Team SoloMid.

But as recently as August 2, the Voyager cryptocurrency exchange backed out of a multi-year sponsorship deal with the US National Women's Soccer League (NWSL). In addition, the exchange is facing bankruptcy after its CEO made millions at the 2021 peak of the cryptocurrency boom.

In comments accompanying its crypto winter report, NRG's Global Head of Insights, Marlon Cumberbatch, said "that the crypto crash hasn't done much to dampen Americans' enthusiasm toward cryptocurrencies – for investors, the recent crash is just the latest in a long series of ups and downs, rather than the start of a terminal decline."

Cumberbatch also offered advice on how companies as big as pro sports teams and small as local businesses might strategize to survive crypto winter. "Start engaging openly and constructively with policymakers," Cumberbatch said, "continue to invest in educating consumers about the technology and promote practical use cases for crypto…"

Cumberbatch also encouraged better cryptocurrency education for everyone. From the C-suite to the penny crypto investor in the street, people need to understand better what they're getting into. "Recent media coverage has done a lot to increase consumer awareness of crypto," he said, "it's not the same as increasing understanding. It's critical that consumers know enough about the technology to be able to make informed decisions and protect themselves from unnecessary risk."

Cumberbatch did not respond immediately after dot.LA reached out for specific comments about crypto company sponsorships such as the Crypto.com and Staples Center deal.

The NRG report on the general state of crypto did not predict doom and gloom but noted that the crypto landscape "is vast, complex, and constantly in flux."

"More than anything else," the report continued, "recent events in the crypto market have made it clear that there's a need to educate potential investors. Before they buy-in, it's vital that consumers understand the technology on more than just a surface level—and that they know enough about crypto to be able to make informed decisions and protect themselves from unnecessary risk. And today's leading crypto firms will have a pivotal role to play in facilitating that educational journey."

Cryptocurrency exchanges have benefited more from their sponsorships than the sponsored organizations, and at minimum, crypto winter has put a dent in more multimillion-dollar deals for now. But if the National Research Group's report proves prescient, this may be a temporary lull in cryptocurrency-oriented companies paying big money for widespread name recognition. Crypto.com arena is here to stay…for now. If crypto winter gives way to a crypto spring, we could see more Coinbase stadiums and Bored Ape Yacht Club restaurants soon.

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

LA Tech Week—a weeklong showcase of the region’s growing startup ecosystem—is coming this August.

The seven-day series of events, from Aug. 15 through Aug. 21, is a chance for the Los Angeles startup community to network, share insights and pitch themselves to investors. It comes a year after hundreds of people gathered for a similar event that allowed the L.A. tech community—often in the shadow of Silicon Valley—to flex its muscles.

From fireside chats with prominent founders to a panel on aerospace, here are some highlights from the roughly 30 events happening during LA Tech Week, including one hosted by dot.LA.

DoorDash’s Founding Story: Stanley Tang, a cofounder and chief product officer of delivery giant DoorDash, speaks with Pear VC's founding managing partner, Pejman Nozad. They'll discuss how to grow a tech company from seed stage all the way to an initial public offering. Aug. 19 at 10 a.m. to 12 p.m. in Santa Monica.

The Founders Guide to LA: A presentation from dot.LA cofounder and executive chairman Spencer Rascoff, who co-founded Zillow and served as the real estate marketplace firm’s CEO. Aug. 16 from 6 p.m. to 9 p.m. in Brentwood.

Time To Build: Los Angeles: Venture capital firm Andreessen Horowitz (a16z) hosts a discussion on how L.A. can maintain its momentum as one of the fastest-growing tech hubs in the U.S. Featured speakers include a16z general partners Connie Chan and Andrew Chen, as well as Grant Lafontaine, the cofounder and CEO of shopping marketplace Whatnot. Aug. 19 from 2 p.m. to 8 p.m. in Santa Monica.

How to Build Successful Startups in Difficult Industries: Leaders from Southern California’s healthcare and aerospace startups gather for panels and networking opportunities. Hosted by TechStars, the event includes speakers from the U.S. Space Force, NASA Jet Propulsion Lab, Applied VR and University of California Irvine. Aug. 15 from 1 p.m. to 5 p.m. in Culver City.

LA Tech Week Demo Day: Early stage startups from the L.A. area pitch a panel of judges including a16z’s Andrew Chen and Nikita Bier, who co-founded the Facebook-acquired social media app tbh. Inside a room of 100 tech leaders in a Beverly Hills mansion, the pitch contest is run by demo day events platform Stonks and live-in accelerator Launch House. Aug. 17 from 12:30 p.m. to 3 p.m. in Beverly Hills.

Registration information and a full list of LA Tech Week events can be found here.

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

© dot.LA All rights reserved