![]() Ekta Mourya

Ekta Mourya

FXStreet

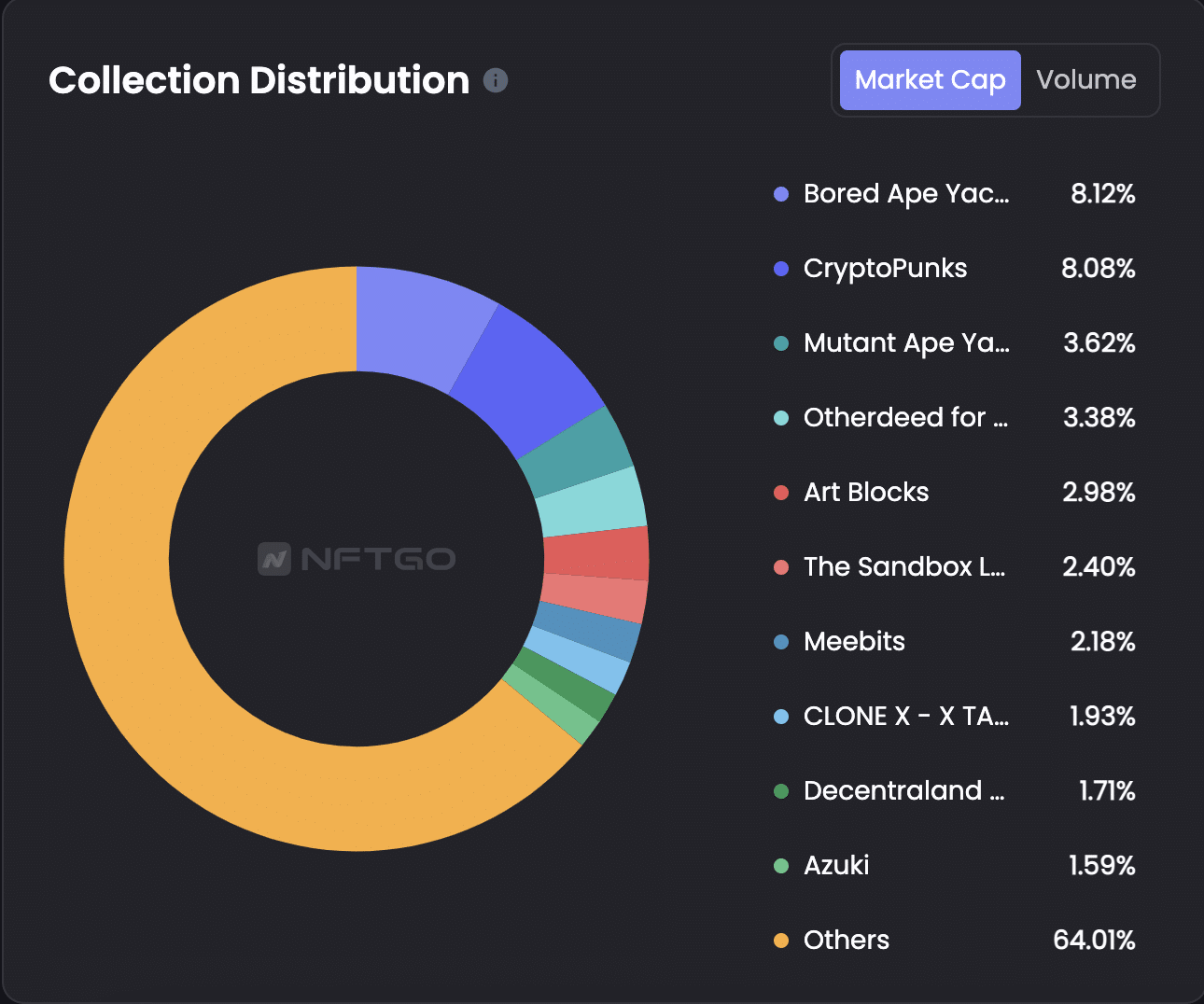

MATIC, the Ethereum scaling solution token is ready for a bullish start in 2023. The NFT volume on Polygon hit a new record with sales of $324 million through the crypto winter. Price outlook on MATIC has turned bullish with long-holders eyeing the $0.8466 level as the target.

Also read: What’s next for ApeCoin after Bored Ape Yacht Club dethrones NFT collections to rank first

MATIC, the Ethereum scaling solution token yielded 3.2% gains for holders over the past 24 hours. The gain coincided with the announcement of a record uptake for Polygon’s NFT OpenSea program in 2022, as well as a spike in volume in the prior week. The Ethereum scaling ecosystem recorded $324 million in NFT sales despite crypto winter surpassing its 2021 OpenSea NFT volume record.

Polygon NFT OpenSea volume

Several NFT collections like y00t, a generative art project of 15,000 NFTs curated by a community of builders and creators have plans to bridge to Polygon in Q1 2023. NFT projects like Aavegotchi have announced plans to remain on the Ethereum scaling solution chain in 2023.

The growing virtual asset and digital collectibles ecosystem on Polygon has fueled a bullish sentiment among MATIC holders during the bear market. Based on data from crypto intelligence tracker Santiment, Polygon’s total NFT trade count and volume in USD registered a spike last week.

MATIC price outlook is bullish and the Ethereum scaling solution could soon break out of its downtrend. A close above the trendline would validate the bullish thesis in MATIC price. MATIC is close to its 50-day exponential moving average (EMA) at $0.7767 and the next resistance is the 200-day EMA at $0.8274.

MATIC/USDT price chart

MATIC bulls are eyeing a 61.8% extension target of $0.8457 from the trendline if they can successfully break above it, in January 2023. A massive bullish breakout could send MATIC price to the $0.8899 level even. If MATIC price wipes out its recent gains and drops below the $0.7500 level, it would invalidate the bullish thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin shorts worth $93.5 million were closed in December 2022, could this be a sign a BTC price rally is imminent? Experts argue late shorts getting liquidated implies a short squeeze, overall sentiment and outlook need to change for bullish breakout.

The Ethereum network surpassed Bitcoin in total transaction volume in 2022. While the largest asset by market capitalization managed to retain its dominance in online search interest and steady transaction

XRP price has been struggling compared to other altcoins, but the worst seems to be over for now. The recent sell-off has washed off the weak bullish hands, providing smart investors with a chance to accumulate.

Bitcoin price shows a clear exhaustion of bullish trend after recovering above a stable support level. This move is likely setting up the stage for a rally for BTC bulls after a quiet end to 2022.

Bitcoin (BTC) price is traversing a channel that is sloping to the upside. Despite the consolidation, BTC is slowly climbing higher like clockwork. The recent Federal Open Market Committee (FOMC) Meeting on December 15 caused BTC to spike beyond the confines of the channel, but things are back to normal.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.