Getty Images

Coinhead

16 hours agoSeptember 26, 2022 |

Link copied to

clipboard

Algorand and XRP are the crypto assets making the biggest moves over the past week. The former related to its FIFA NFT partnership, the latter still riding on court-case positivity. Meanwhile the Optus data hacker digs Monero.

More on those things further below.

The week is well and truly underway here in Australia, but at the time of writing Bitcoin, and the rest of the crypto market, is only just “closing” out its week elsewhere. Some folks seem a little nervous about it.

What is this crypto market “close”? Isn’t crypto the financial market that never sleeps? Yep, that’s right, but for the sake of charting and technical analysis (also known as mumbo jumbo to the vast uninitiated), it’s generally accepted that the daily and weekly close occurs at midnight UTC. And it’s imminent.

Bitcoin is back under US$19k and, according to Cointelegraph as well as other analytical minds, BTC’s latest weekly close looks set to be the lowest since 2020 if it remains around its present level.

Trading account Crypto Yoddha expressed the week ahead’s importance for shaping the crypto market’s direction…

$BTC

The whole week traded within the monday range. Weekly close gonna be bearish, looking like a pin bar.

Also consolidating at the range low. So need a bounce first before taking a position. Next week is gonna be important. (Q3 close + Monthly close)#Bitcoin https://t.co/rRrJlWr9wW pic.twitter.com/dwzjiTa4TX

— Crypto Yoddha (💙,🧡) (@CryptoYoddha) September 25, 2022

While economist Alex Krüger seems to think things could get a little worse in the short term before a pretty nice, potential bounce. If that’s an accurate assessment, then, well – enjoy the ride.

Thinking lower then higher

Replay of June CPI week on equities, crypto to outperform once bounce is on, as it has been showing relative strength (heavy spot buyers last two days).

strong bounce =/ new multi-week upwards trend https://t.co/3bcg73OH5N

— Alex Krüger 🇦🇷 (@krugermacro) September 24, 2022

Dutch trader Michaël van de Poppe, meanwhile, is looking at the continued macro/soaring inflation effects that have really found an extra gear in the past week or so.

#Bitcoin on a narrow range here, which means that volatility is going to kick in during the next week.

Why?

– We've got a ton of volatility across markets as things are breaking (currencies / energy / commodities).

– Euro CPI

– US PCE

Test of $19.5K -> breakout likely. pic.twitter.com/7qZUjHihUi

— Michaël van de Poppe (@CryptoMichNL) September 25, 2022

Onto some daily price action and other happenings.

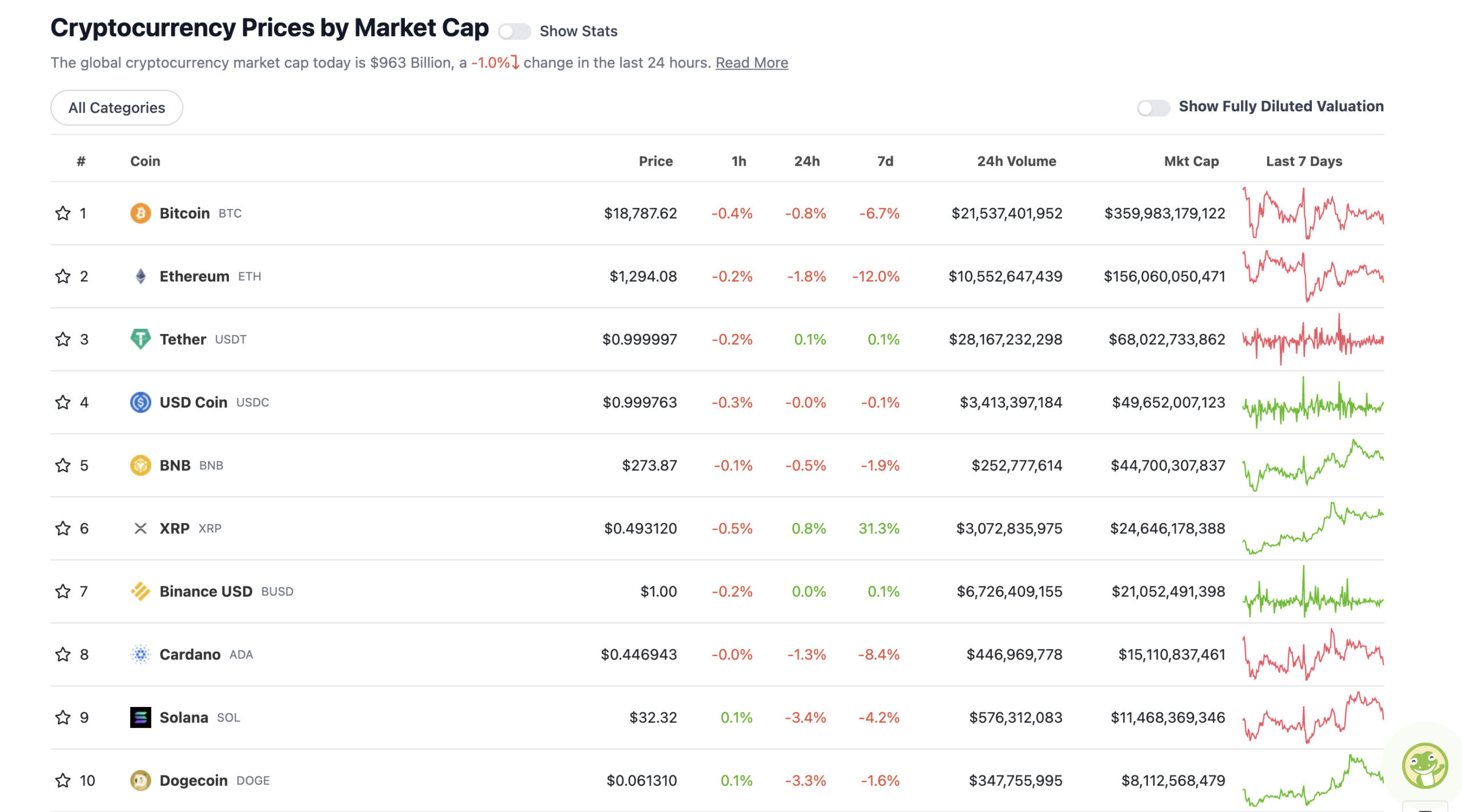

With the overall crypto market cap at US$963 billion and down about 1% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

A Bitcoin weekly close below US$18,800, then and so far a slowish bleed into the week for the crypto majors… except for XRP.

The crypto industry’s most prominent currency-rail project continues to grab the headlines, the analysis and speculation, and the gains at the moment. And, judging by this tweet from an XRP community member, it continues to grab the attention of whale investors, too.

I had a little spare change lying around so…

— Jeremy Hogan (@attorneyjeremy1) September 25, 2022

Sweeping a market-cap range of about US$7.46 billion to about US$386 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Tokenize Xchange (TKX), (market cap: US$599 million) +8%

• Maker DAO (MKR), (mc: US$638 million) +5%

• ApeCoin (APE), (mc: US$1.8 billion) +5%

• Algorand (ALGO), (mc: US$2.7 billion) +3%

• Cosmos Hub (ATOM), (mc: US$4.1 billion) +3%

• Chainlink (LINK), (mc: US$3.87 billion) +3%

Algorand is a proof of Stake layer 1 blockchain and competitor to the likes of Ethereum, Solana, Cardano, Polkadot, Cosmos, Avalanche and more. It may not be leading the daily price action in this category, but it’s been doing extremely well over the past week.

In fact, it’s up more than 32% over seven days, at the time of writing.

Why? The fact that it has an official partnership with FIFA to launch World Cup NFTs might have something to do with it!

New users are coming to @Algorand as it launches the official FIFA World Cup NFTs

New addresses making their first $ALGO transaction have climbed from 5k a day to 20k a day within three months pic.twitter.com/JFIpQ6ndHz

— IntoTheBlock (@intotheblock) September 22, 2022

The International Federation of Association Football has now launched its NFT marketplace FIFA+ Collect. And it’s built on the Algorand blockchain – a massive coup for the layer 1 project.

Last week, FIFA introduced its “Genesis Drop” NFTs containing notable football highlights (in the form of art/imagery) from FIFA history. The drop was launched with 532,980 editions, with each containing three such moments.

A lot of work with @FIFAcom to make history with @FIFAPlusCollect today on @Algorand! https://t.co/9O7zAQAC5h

— wsford.algo (@wsford) September 22, 2022

DAILY SLUMPERS

• Terra Luna Classic (LUNC), (market cap: US$1.4 billion) -13%

• Celsius Network (CEL), (mc: US$612 million) -8%

• Ravencoin (RVN), (mc: US$446 million) -6%

• Lido DAO (LDO), (mc: US$1 billion) -5%

• Arweave (AR), (mc: US$470 million) -5%

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

As reported by Alex Turner-Cohen for news.com.au, a person “claiming to be the evil genius responsible for the Optus data breach” has demanded more than AUD $1.5 million in ransom money from the telco – to be paid in the crypto “privacy coin” Monero (XMR).

The hacker claims to have gleaned important data about roughly 11.2 million Optus customers, including names, dates of birth, phone numbers, email addresses, and even some ID document numbers.“Optus if you are reading! price for us to not sale data is 1.000.000$US We give you 1 week to decide,” part of their message reads on the forum.

According to the report, the ransom demand appeared on a forum early on Saturday morning and experts so far seem to think it’s legitimate.

Optus hacker wants $1.5m ransom to be made in @monero.

“Optus if you are reading! price for us to not sale data is 1.000.000$US We give you 1 week to decide,”https://t.co/ERrLYEjMIj

— Amy-Rose Goodey (@amydashrose) September 25, 2022

Why Monero? The XMR token is widely considered the leading privacy coin in crypto. These are highly decentralised and controversial assets as they use privacy-enhancing technology to obfuscate transactions and transaction history, thus achieving a level of anonymity that makes its users very difficult to trace.

Needless to say, privacy coins are generally not popular with governments.

Speaking of governments and things that are hugely controversial, though, it’s interesting to watch Russia’s evolving stance on cryptocurrency.

RUSSIA: The largest stock exchange, Moscow Exchange, is preparing to become a cryptocurrency exchange

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) September 25, 2022

Moscow Exchange (MOEX), the largest exchange organisation in the country, is reportedly looking to enable trading in digital financial assets (DFAs) and securities trading based on a set of bills currently being put together.

The Bank of Russia has also reportedly been considering the possibility of legalising crypto for the purpose of international/cross-border payments in the near future.

Meanwhile, Washington is still figuring out its stance but is “increasingly changing its perspective on crypto”, according to the Coinbase exchange’s chief policy officer Faryar Shirzad.

https://t.co/1b9XdyKyEI

— naiive (@naiivememe) September 25, 2022

We're part of the solution. November 23 & 24 in Melbourne, let's go!https://t.co/1467CE6a80

— NFT Fest Australia | 23rd & 24th November (@NFTFestAus) September 25, 2022

One day, a #BTC Bull Market will come

But today is not that day#Crypto #Bitcoin

— Rekt Capital (@rektcapital) September 25, 2022

Playful bear seems to dance in the forest pic.twitter.com/KJZjyinlhj

— Gabriele Corno (@Gabriele_Corno) September 25, 2022

Link copied to

clipboard

Get the latest Stockhead news delivered free to your inbox.

"*" indicates required fields

It’s free. Unsubscribe whenever you want.

Read our privacy policy

Coinhead

September 26, 2022 <time class="updated" datetime="2022-09-26 21:13:25"September 26, 2022 |

Coinhead

September 26, 2022 <time class="updated" datetime="2022-09-26 13:22:25"September 26, 2022 |

Coinhead

September 26, 2022 <time class="updated" datetime="2022-09-26 15:25:59"September 26, 2022 |

Health & Biotech

Get the latest stock news

and insights straight to your inbox.

"*" indicates required fields

Read our privacy policy

Stockhead is providing factual information where there is a reasonable likelihood of doubt.

The information is not intended to imply any recommendation or opinion about a financial product.

For investors, getting access to the right information is critical.

Stockhead’s daily newsletters make things simple: Markets coverage, company profiles and industry insights from Australia’s best business journalists – all collated and delivered straight to your inbox every day.

Markets coverage, company profiles and industry insights from Australia’s best business journalists – all collated and delivered straight to your inbox every day.

It’s free. Unsubscribe anytime.

Learn more about our Privacy Policy.

"*" indicates required fields

Get the latest Stockhead news delivered free to your inbox.