Get the 5-minute newsletter keeping 73K+ crypto innovators in the loop.

© Defiant Media Inc 2022

Advertisement

Advertisement

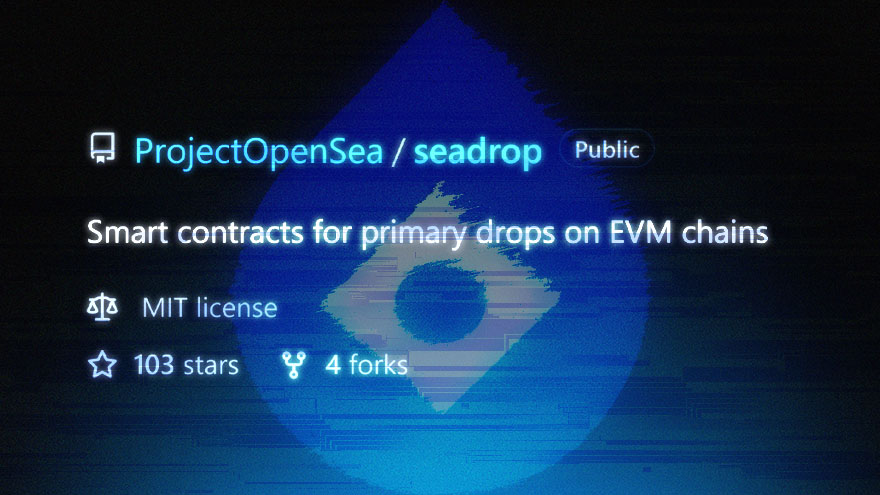

SeaDrop Refines NFT Minting and Drop Process

By: Tarang Khaitan

OpenSea, the leading NFT marketplace, has launched SeaDrop, an open-source smart contract that allows NFT project creators to skip the tedious task of deploying their own custom smart contracts.

SeaDrop handles all the technical complexities and creators gain more control as they are able to set drop times, add allow-lists, and even have tiered versions of allowlists.

In addition, the feature enables drops across Ethereum Virtual Machine (EVM) compatible blockchains and currently supports Ethereum and Polygon. However, the company will soon add support for Optimism, Arbitrum, Avalanche, Gnosis Chain, and BNB Chain.

SeaDrop supports public, allow-list, token-gated, and server-signed mint options. Drops registered with SeaDrop can easily be indexed or tracked as the activity is recorded on-chain. Moreover, bulk minting on SeaDrop is expected to be cheaper due to gas optimizations used by the development team.

Despite the ongoing market downturn which has seen the cumulative trading volume across all NFT marketplaces drop over 97% in the span of five months, OpenSea has been making strides to further cement its position as the leading NFT marketplace.

Last month, OpenSea added support for two Ethereum Layer-2 scaling solutions: Arbitrum and Optimism. This brings the tally of OpenSea’s supported networks to six, namely Ethereum, Solana, Polygon, Klatyn, Arbitrum, and Optimism.

In May, OpenSea launched a new protocol dubbed Seaport, which allows users to place bids on NFTs using ERC-20 tokens and ERC-721 tokens. Users can essentially barter their NFTs for any combination of assets they desire.

OpenSea’s new Seaport protocol will let users post offers for NFTs with a broad range of assets including ERC20, ERC721, and ETH.

In April, OpenSea acquired Gem, a popular NFT aggregator which allows users to buy multiple NFTs across diverse marketplaces in a single transaction.

OpenSea’s primary competitors are X2Y2 and Magic Eden. Interestingly, both its competitors charge lower trading fees in a bid to capture market share. OpenSea charges 2.5% while Magic Eden’s trading fees are 2%, and X2Y2 is even cheaper at 0.5%.

OpenSea still remains firmly in the top spot, according to DappRadar. The protocol generated trading fees of $253M in the past 30 days, compared to $165M for X2Y2 and $128M for Magic Eden during the same period.

Get the 5-minute newsletter keeping 75K+ crypto innovators in the loop.

Samuel Haig•

Samuel Haig•

Aleksandar Gilbert•

Rahul Nambiampurath•

Samuel Haig•

Advertisement