The global crypto market cap is $ with a 24-hour volume of $. The price of Bitcoin is $22,989.12 and BTC market dominance is %. The price of Ethereum is $1,582.10 and ETH market dominance is %. The best performing cryptoasset sector is Media, which gained 14%.

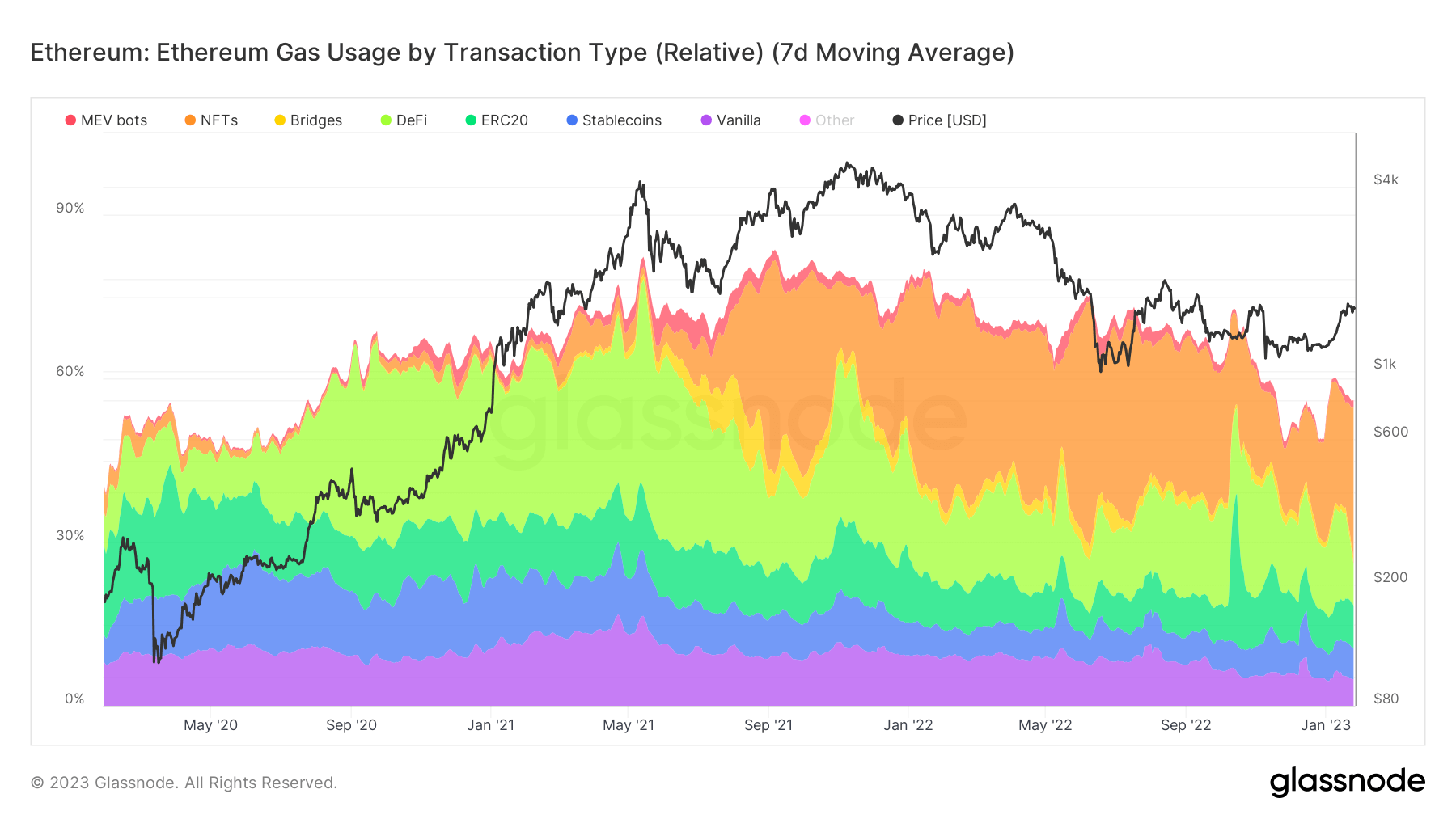

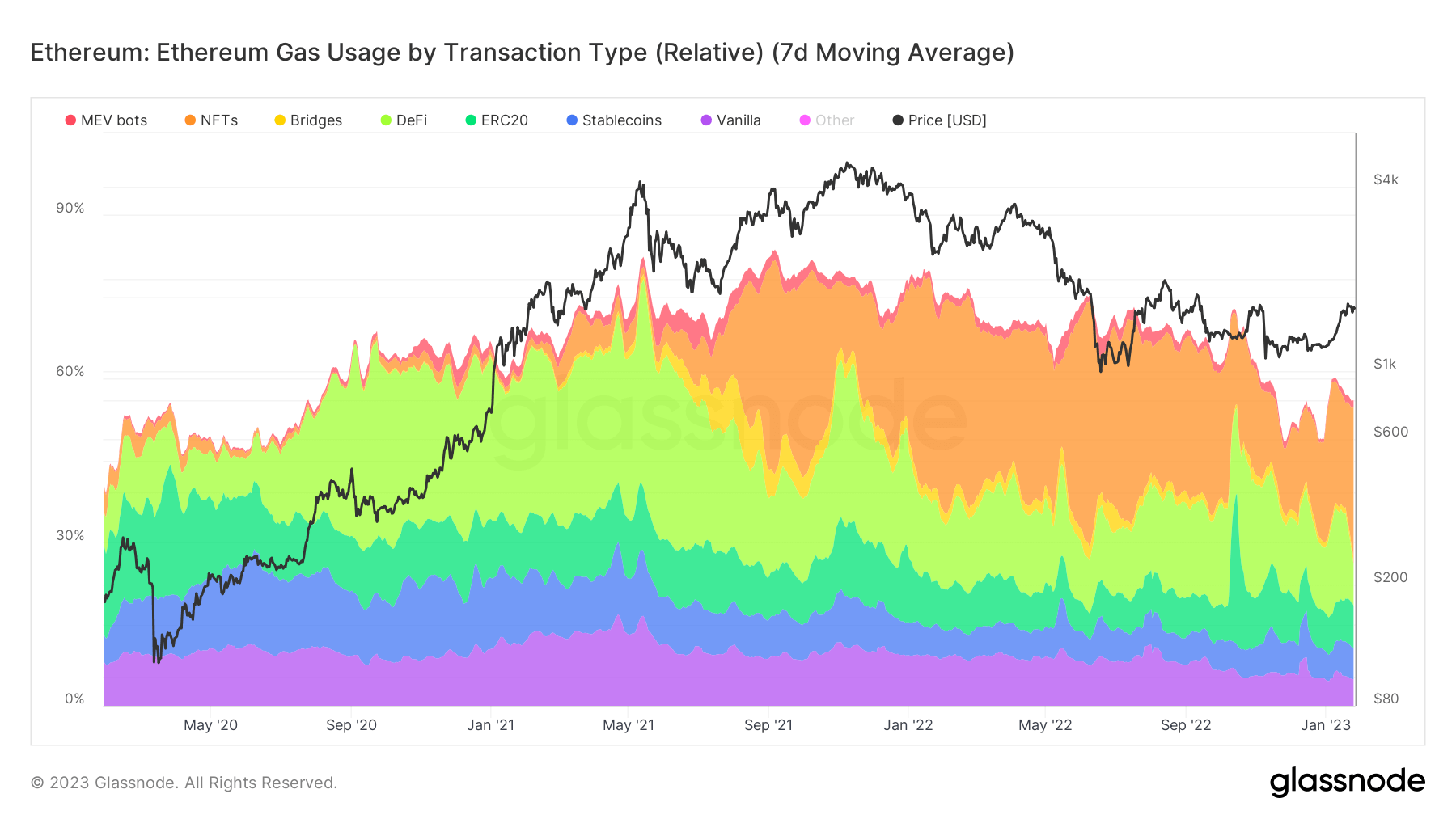

The Defi, ERC20, and stablecoins categories occupy the second, third, and fourth largest share with 8%, 8%, and 6%, respectively.

Cover art/illustration via CryptoSlate

CryptoSlate analysts examined the gas usage shares of different transaction categories on the Ethereum (ETH) network and found that the NFTs category accounted for 28% in the first month of the year.

The analysis divides all transactions on the ETH network into eight categories as Vanilla, ERC20, Stablecoins, DeFi, Bridges, NFTs, MEV Bots, and others.

The second, third, and fourth categories that occupied the most significant gas usage by share appeared as Defi, ERC20, and stablecoins, with 8% for Defi and ERC20 and 6% for stablecoins.

The vanilla category includes pure ETH transfers between Externally Owned Accounts (EOAs) issued without calling any contracts. The ERC20 class counts all transactions that call ERC20 contracts, excluding stablecoin transactions.

The stablecoins category represents all fungible tokens that have their value pegged to an off-chain asset either by the issuer or by an algorithm. This category includes over 150 stablecoins, with Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI) being the most prominent ones.

The Defi category covers all on-chain financial instruments and protocols implemented as smart contracts. Decentralized exchanges (DEXs) also fall under this category. More than 90 Defi protocols are represented under this section, including Uniswap (UNI), Etherdelta, 1 inch (1INCH), Sushiswap (SUSHI), and Aave (AAVE).

Bridges represent all contracts that allow the transfer of tokens between different blockchains and includes over 50 bridges such as Ronin, Polygon (MATIC), Optimism (OP), and Arbitrum (ARBI).

All transactions interacting with non-fungible tokens fall under the NFTs category. This section includes both ERC721 and ERC1155 token contract standards and NFT marketplaces for trading them.

MEV bots, or Miner Extractable Value bots, represent bots that automatically execute transactions for profit by reordering, inserting, and censoring transactions within blocks.

All remaining ETH transactions are gathered under the Other category.

The chart below represents the relative amount of gas consumed by each category in the ETH network. The chat starts from January 2020 and represents the gas usage share of each category with a different color.

At first glance, the NFTs, Defi, ERC20, Stablecoins, and Vanilla categories stand out as they have the most visible shares in total gas fees.

At first glance, the NFTs, Defi, ERC20, Stablecoins, and Vanilla categories stand out as they have the most visible shares in total gas fees.

According to the data, the NFTs category currently accounts for 28% of the total gas fees on the ETH network, which is represented with the orange zone. This category’s share was only around 4% in early May before the pandemic started.

The Defi takes up the second largest share with 8%, represented by the light green area. Both the NFTs and the Defi category recorded an increase in gas fee shares since the pandemic started. The ERC20 category accounts for 8% of the total gas share. Represented by the dark green area, the category’s share halved from 16% in October 2022.

In the meantime, stablecoins’ percentage remained flat, around 5-6%, as can be seen from the dark blue zone as well. Finally, the vanilla category continued to account for around 5% of total gas fees.

Looking at the gas usage of the NFTs category in detail, OpenSea appears as dominant. The chart below represents the NFT marketplaces’ share in gas usage since the beginning of 2018.

OpenSea appeared in early 2020 and significantly increased its share in gas usage after mid-2021. It remains the dominant NFT marketplace that occupies enough gas usage to leave a mark on the overall chart, except for a short period in January 2022, where LooksRare accounted for enough gas usage to appear briefly next to OpenSea.

The breakdown of the gas usage share of stablecoins also emphasizes USDT’s dominance. The chart below represents major stablecoins’ gas usage shares from the beginning of 2018.

Even though USDT remains the dominant stablecoin, its share still recorded a significant decrease from 11% to 4%. On the other hand, USDC became visible on the chart in early 2020 and has been growing its share in gas usage slowly but steadily since then.

Zeynep is an academic who turned to crypto in 2018. Originating in social sciences, she is especially interested in the social impact of blockchain and cryptocurrencies and strongly believes in their transmuting power.

Directly from this Widget: the top CEXs + DEXs aggregated through Orion. No account, global access.

Commitment to Transparency: The author of this article is invested and/or has an interest in one or more assets discussed in this post. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. Please take that into consideration when evaluating the content within this article.

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Ethereum is a decentralized, open-source blockchain platform that enables the creation of smart contracts and decentralized applications (DApps).

Launched in 2014, Tether is a blockchain-enabled platform designed to facilitate the use of fiat currencies in a digital manner.

USD Coin (USDC) is a stablecoin fully backed by the US dollar and developed by the CENTRE consortium.

BUSD is a stablecoin issued by Paxos in partnership with Binance..

Dai (DAI) is a cryptocurrency token and operates on the Ethereum platform.

Since its inception, the Uniswap Protocol (“Uniswap”) has served as a trustless and highly decentralized financial infrastructure.

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and is capable of splitting a single trade transaction across multiple DEXs.

SushiSwap is an automated market-making (AMM) decentralized exchange (DEX) currently on the Ethereum blockchain.

Aave is an open source and non-custodial protocol enabling the creation of money markets.

Polygon (previously Matic Network) is a protocol and a framework for building and connecting Ethereum-compatible blockchain networks.

Optimism is a layer-2 scaling network for the Ethereum blockchain.

Arbitrum is a type of technology known as an optimistic rollup.

Developments around the defunct FTX exchange and its former leader have emerged.

The wMarket Update condenses the most important price movements in the crypto markets over the reporting period, published 07:45 ET on weekdays.

The project is using LayerZero to expand its current Ethereum blockchain to improve ease of access and network capability.

The NFT integration will allow over 200 million Little Red Book users to mint their profile pictures on the Conflux blockchain.

FTX funded FUD against Binance and the impact of AI in crypto were discussed during a recent Twitter AMA with the Binance CEO.

Porsche faces backlash from crypto community, severely criticizing the expensive mint price and ‘cash-grab’ sales strategy.

Roughly $50 million of SBF’s deposit has been seized by prosecutors – Alameda invested $11.5 million earlier in the same bank.

Bitcoin crashes through $23k as the bear market rally continues

The fake Pi token reached a trading volume of $46.8 million on Huobi, becoming the most traded token on the exchange over the past 24 hours.

The floor price for the former president’s NFT collection is around 0.16 ETH.

Logan Paul said he was knifed in the back by people he trusted and intends to sue Coffeezilla over unethical and sloppy journalistic practices.

Some charities have voluntarily agreed to return the funds, some have already spent the money, while others are awaiting legal clarity.

Breaking through resistance: Understand the factors driving Bitcoin’s surge past $21,000 in our latest market report.

Got a story tip? Email [email protected]

Disclaimer: By using this website, you agree to our Terms and Conditions and Privacy Policy. CryptoSlate has no affiliation or relationship with any coin, business, project or event unless explicitly stated otherwise. CryptoSlate is only an informational website that provides news about coins, blockchain companies, blockchain products and blockchain events. None of the information you read on CryptoSlate should be taken as investment advice. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own diligence before making any investment decisions. CryptoSlate is not accountable, directly or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

© 2023 CryptoSlate. All rights reserved. Terms | Privacy

Please add “[email protected]“ to your email whitelist.

Stay connected via