![]() Aaryamann Shrivastava

Aaryamann Shrivastava

FXStreet

There has been a significant increase in interest in Solana NFTs over the past few months, leading to an influx of new traders and buyers. The biggest NFT marketplace on the blockchain, MagicEden, has been the biggest receiver of this growing interest. Naturally, the marketplace also became the target of scammers.

Solana NFT traders noted the appearance of fraudulent non-fungible tokens (NFTs) from famous collections like ABC on the biggest marketplace on the network, MagicEden. The fake NFTs were being sold as part of the collections for high values despite being worth next to nothing.

Upon discovery, MagicEden took action and brought the exploit to an end before the situation got worse. The NFT marketplace stated that they had fixed the issue of fake NFTs being listed on collection pages as well as the appearance of fake NFT transactions.

Adding to the same, MagicEden confirmed that less than ten collections were impacted by the exploit and that an incident review will be published soon.

Metaplex, a Solana-based NFT minting and development platform, announced that the problem of fake NFTs was not evident on their platform The platform further stated,

“There is an on-going bug on Magic Eden that allows an attacker to list and sell fake NFTs that are not part of a creator’s verified collection… To avoid this, marketplaces should check (a) that the collection address matches and is verified OR (b) that the creator addresses match and all are verified. We recommend the former.”

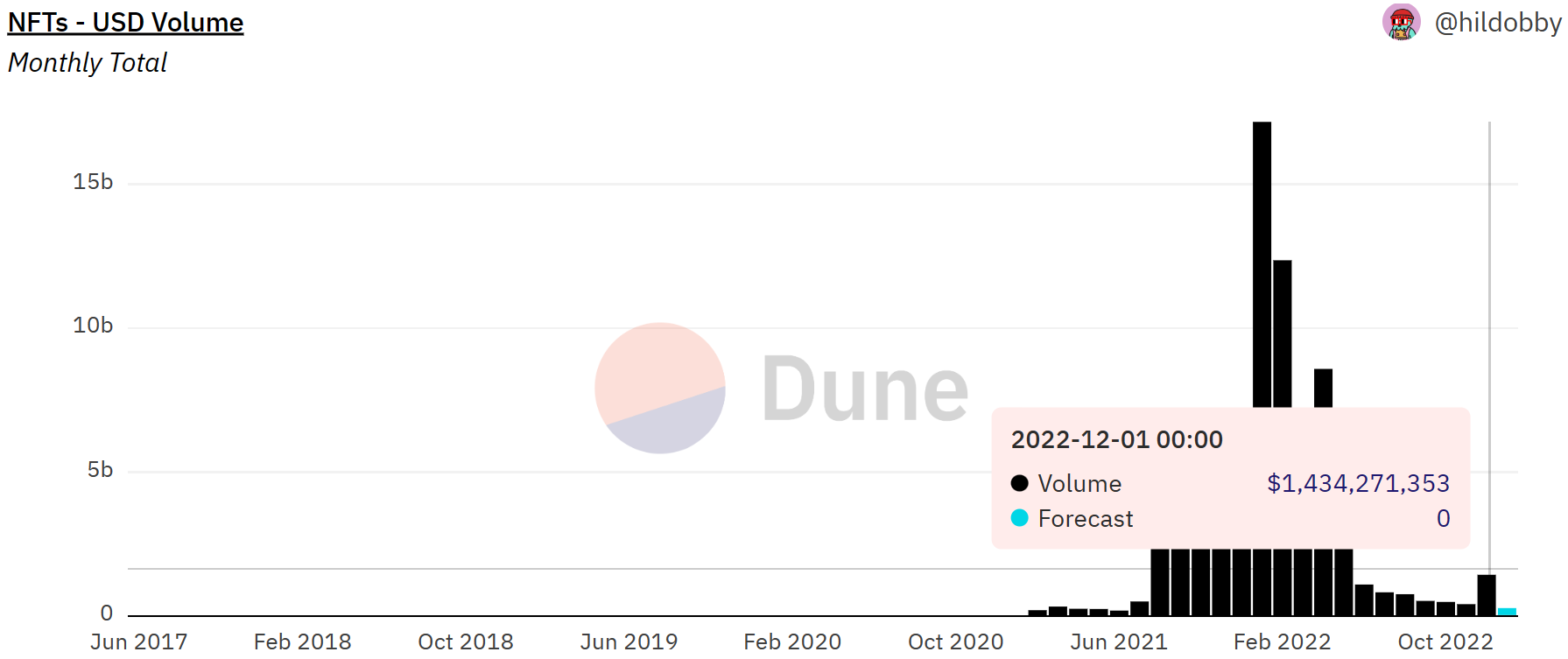

NFTs across the crypto space had been registering a month-on-month decline in sales throughout 2022. While December was expected to follow suit, a sudden increase in transactions noted the monthly sales skyrocketing by 246%.

NFT sales monthly volume

The end-of-year sales for the month of December pushed the total volume from $410 million to $1.43 billion, marking the highest sales in about seven months. At the moment, January 2023 is expected to pull in just $300 million. However, a sudden spike in interest might increase the final figure.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Algorand price fell by 25% during December. Algorand price has shaken investors to the core as market makers have forged a monthly close within 2020’s trading range. The bears may be able to induce a 50% downswing sometime in 2023.

Three Arrows Capital liquidators, led by Teneo, are seeking documents related to the company’s accounts, digital assets and other papers. US and Singapore courts approved the unusual method of subpoena.

Crypto.com price has risen by 7% since the start of the new year. The CRO price has an untagged liquidity level from 2020, which is 12% below the current market value. A breach below $0.0550 could be the start of a 12% downtrend.

Ethereum price wiped out its recent losses and rebounded above the $1,260 level. Large wallet investors on the altcoin’s network started scooping up ETH tokens through the Dec 16 local bottom in the ETH price chart.

Bitcoin (BTC) price is traversing a channel that is sloping to the upside. Despite the consolidation, BTC is slowly climbing higher like clockwork. The recent Federal Open Market Committee (FOMC) Meeting on December 15 caused BTC to spike beyond the confines of the channel, but things are back to normal.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.