The headlines wreak of doom and gloom across the world, and the non-fungible token (NFT) market is no exception. But there are unexpected signs of strength in the NFT space that I believe will pull through the bear market.

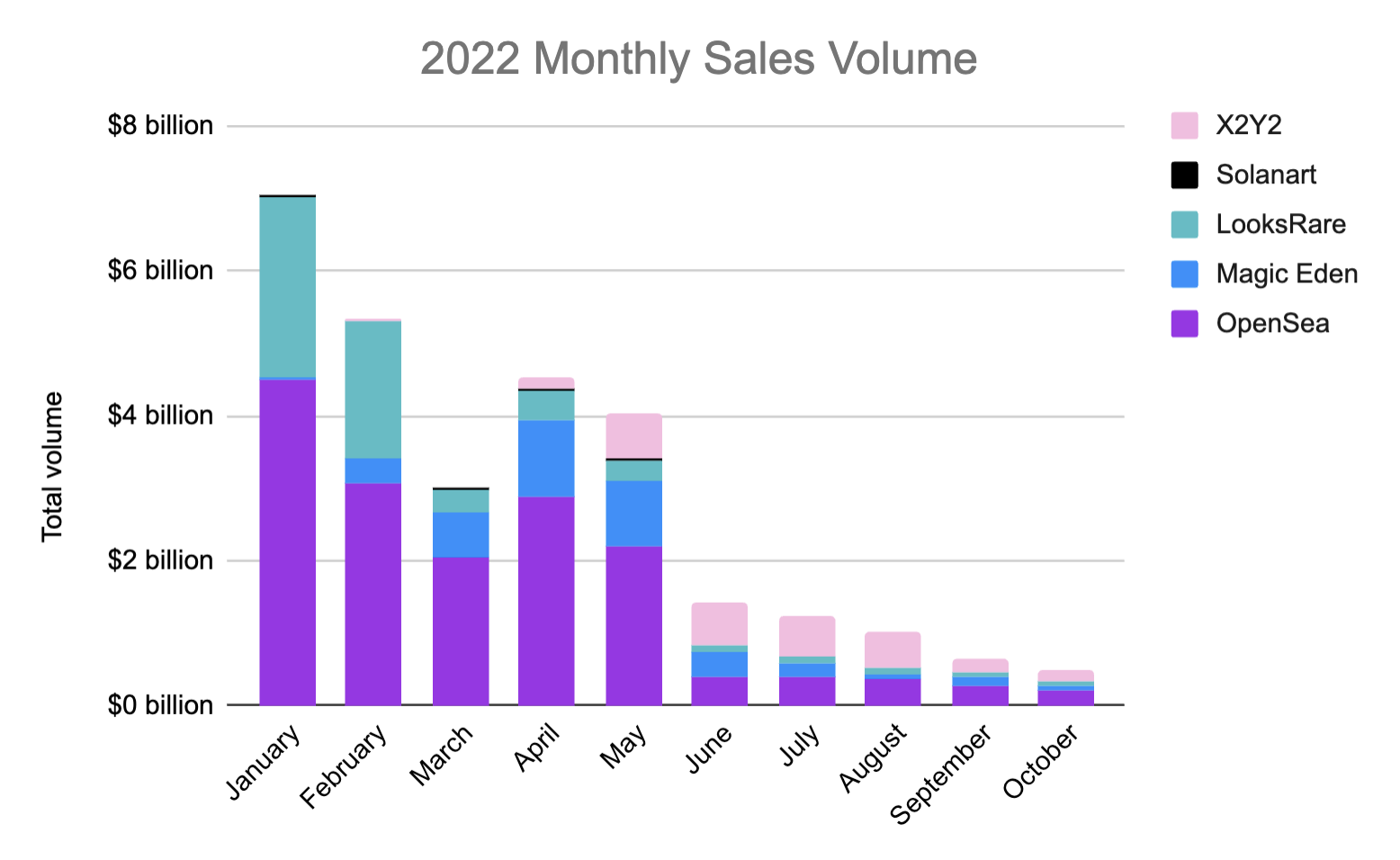

Alarm bells began to ring when NFT marketplaces experienced a mass contraction from exponential highs of the first few months of this year.

The latest Balthazar NFT Marketplace Update recorded US$494.27 million in sales volume in October 2022 across five top NFT marketplaces combined: OpenSea, Magic Eden, LooksRare, Solanart and X2Y2. This is 93 percent down from January, which saw US$7.06 billion in sales. Black Bear Value Fund update for the month ended October 31, 2022. Q3 2022 hedge fund letters, conferences and more Dear Partners and Friends, Black Bear Value Fund (the “Fund”) returned +9.5%, net, in October and +10.3% for 2022. The HFRI returned +4.3% in . . . SORRY! This content is exclusively for paying members. Read More

Black Bear Value Fund update for the month ended October 31, 2022. Q3 2022 hedge fund letters, conferences and more Dear Partners and Friends, Black Bear Value Fund (the “Fund”) returned +9.5%, net, in October and +10.3% for 2022. The HFRI returned +4.3% in . . . SORRY! This content is exclusively for paying members. Read More

Get The Full Henry Singleton Series in PDF

Get the entire 4-part series on Henry Singleton in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q3 2022 hedge fund letters, conferences and more

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

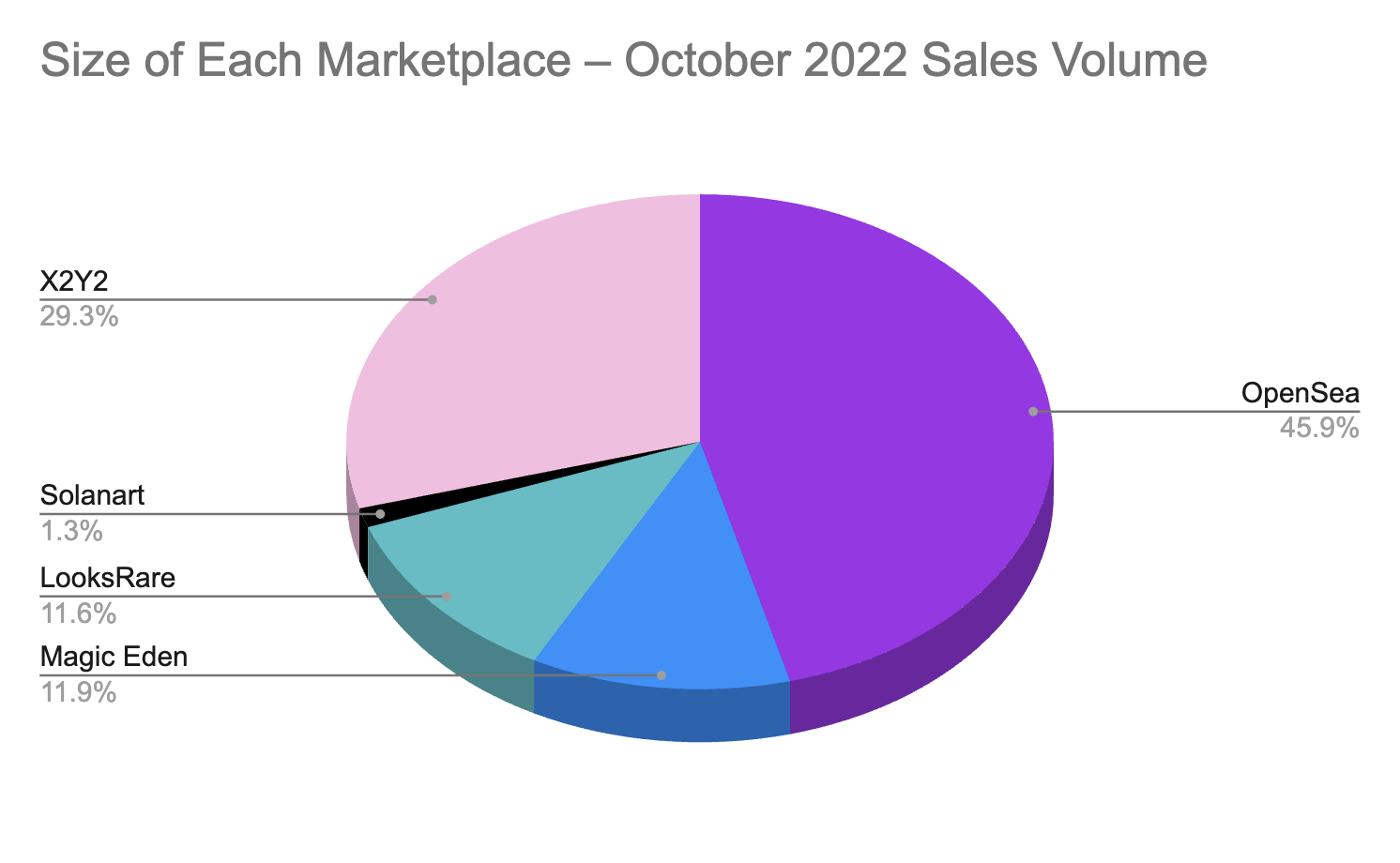

However, in February 2022, there was a new player in town. X2Y2 marketplace was launched with US$11.04 million in sales volume in its first month, and has grown 1,213 percent by October, to US$145.04 million in sales volume. In eight months it has become the number two marketplace on Ethereum.

Collectively, October NFT sales were the lowest level for 2022, down by US$147.28 million from September (-23%).

Source: Balthazar, DappRadar

But not all NFT marketplaces saw a month-on-month decline. In fact, two marketplaces saw increases in NFT sales.

LooksRare recorded a 10.61 percent increase in sales in October compared to September – up by US$5.51 million to US$57.47 million. While Solanart saw a 38.21 percent rise, up by US$1.73 million to US$6.25 million.

OpenSea, the largest NFT marketplace in the world, has recorded a decline in sales volume since April 2022. It was down by 15.52 percent in October from September, with US$41.69 million lower sales volume. It recorded US$226.86 million in sales in October.

X2Y2 dropped by 22.98 percent in October, while Magic Eden saw the biggest decline of 54.25 percent, down by $69.55 million compared to September.

On the flipside, despite the declining trend, 2022 sales volume to October has doubled that of 2021. The total sales volume for the five marketplace combined was US$14.29 billion in 2021, compared to US$28.80 billion in 2022 to October.

The most intriguing part of this research report shows a rise in market share by X2Y2 at the detriment of OpenSea’s stranglehold of the market. In January, OpenSea held 63.7 percent of market share across the five markets, and by June, it dropped more than half to 29 percent.

In contrast to X2Y2, which saw a 3.4 percent share of the sales volume in April, to 15.7 percent in May, and 49.2 percent by August. In October, X2Y2 recorded 29.3 percent.

Some fundamental changes occurred during this time. In June, X2Y2 offered a promotion for no fees and in August it stopped requiring buyers to pay royalties.

There is some very aggressive marketing happening in the space that is resulting in a shift in dominance. This is sending a very strong signal that new players are entering the space and pushing hard with explosive growth.

Source: Balthazar, DappRadar

Another comforting sign is that the number of users has not dwindled away during the bear market. In fact, if we look at the total number of users in February (2.09 million) when X2Y2 launched, there were just 12.6 percent fewer in October (1.82 million). And September (2.04 million) saw almost the same number of users as February.

Even though there was a 10.6 percent drop in users from September, the number of users has remained between 1.75 million and 2.44 million (at its peak in May) this year.

Users are also trading more than ever. The Balthazar report recorded 26.83 million trades in October, compared to 3.78 million trades in January. But they are spending less per trade. The average trade in October was US$898, down 20.3 percent from September (US$1,127).

While the market has come off radical highs, which was expected, we’re going to see a more gradual, less volatile level of growth once the market recovers. And the past 10 months have shown that this bear market is holding down the hatches with surprise activity from traders, investors and new projects hitting the market.

Never Miss A Story!

Subscribe to ValueWalk Newsletter. We respect your privacy.

(function () {

var jo = document.createElement(‘script’);

jo.type = ‘text/javascript’;

jo.id = ‘FJVoiceFeed’;

var r = Math.floor(Math.random() * (9999 – 0 + 1) + 0);

jo.src = ‘https://www.financialjuice.com/widgets/voice-player.js?mode=inline&display=1&container=FJ-voice-news-player&info=valuewalk&r=’ + r;

document.getElementsByTagName(‘head’)[0].appendChild(jo);

})();

ValueWalk.com is a highly regarded, non-partisan site – the website provides unique coverage on hedge funds, large asset managers, and value investing. ValueWalk also contains archives of famous investors, and features many investor resource pages.

Mission: Providing a framework to improve your investing PROCESS, while collecting newsworthy information about trends in business, politics and tech areas.

Please speak to a licensed financial professional before making any investment decisions.