![]() Ekta Mourya

Ekta Mourya

FXStreet

ApeCoin, an Ethereum-based NFT token, yielded nearly 10% gains for holders over the past 14 days. APE is the native token of the Bored Ape Yacht Club (BAYC) ecosystem. BAYC hit a new milestone in 2022 dethroning other blue-chip NFTs like CryptoPunks to rank first in terms of market capitalization.

Also read: Ethereum whales scoop up Shiba Inu tokens; here’s what to expect

ApeCoin is the native token of the Bored Ape Yacht Club universe. BAYC is an NFT collection that features 10,000 digital art pieces and competes with blue-chip collectibles in the ecosystem.

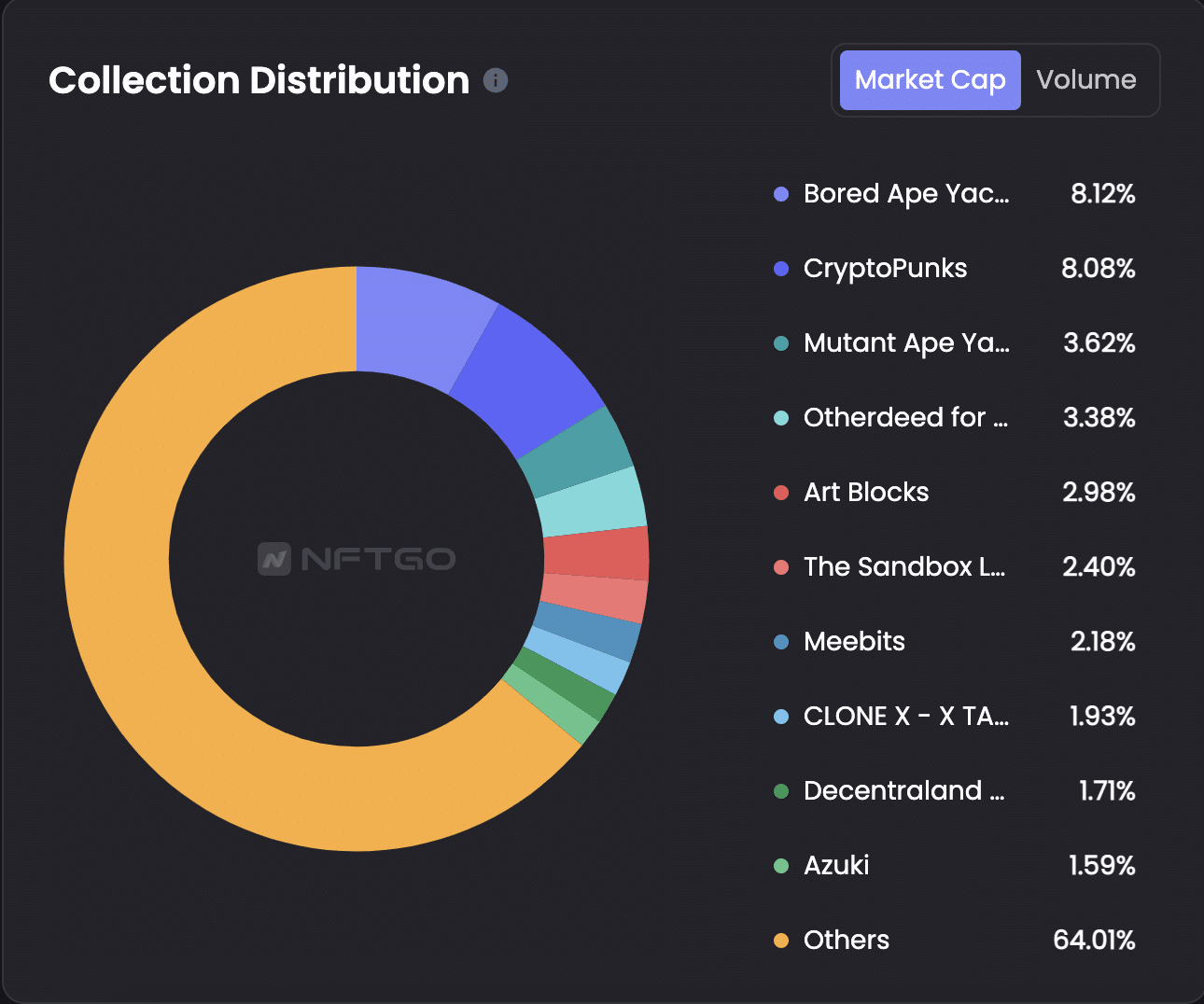

Based on data from NFTGo, CryptoPunks, a collection of 10,000 algorithmically generated pixel NFTs ranked first in terms of market capitalization at the start of 2022 when the pixelated collectibles held 10% of the entire NFT market cap share. This changed in the second half of the year with Bored Ape Yacht Club taking the lead.

BAYC closed 2022 with a market cap of $830 million. This makes the 10,000 Ape collection the highest grossing in the ecosystem. Despite a steady decline in its value throughout 2022, BAYC replaced CryptoPunks as number one, at 8.12% of the NFT ecosystem, against CryptoPunks 8.08%.

NFT collection distribution at the end of 2022

Since the beginning of 2023, BAYC has recorded 17 sales and sales volume is up 51% over the last 24 hours. The sales totaled $1.37 million, with the Ape collection’s revenue coming second to Otherdeed.

Whilst BAYC is doing well the ApeCoin token is struggling to recoup its losses. ApeCoin has offered holders nearly 10% gains in the past two weeks, unlike mainstream cryptocurrencies like Bitcoin and Ethereum.

The NFT token is currently in an uptrend, however technical indicators reveal ApeCoin is overbought and thus ready for a pull back or reversal.

The Relative Strength Index, a momentum indicator used to determine whether a token is overbought or oversold and indicates trend reversals reads 81.44 for ApeCoin. A reading above 70 implies that the asset is overbought and there is a likelihood of a correction in its price.

ApeCoin price is therefore at the risk of a decline as seen in the chart below. The signal for traders to open short positions is traditionally given when the RSI exists overbought after having entered the area.

APE/USDT price chart

Interestingly, the 50-day Exponential Moving Average (EMA) recently crossed below the 200-day EMA, in a “death cross.” The death cross is a chart pattern that signals weakness in the asset’s price. These technical indicators suggest ApeCoin price could plummet to support at the 200-day EMA at $3.723.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price shows a clear exhaustion of bullish trend after recovering above a stable support level. This move is likely setting up the stage for a rally for BTC bulls after a quiet end to 2022.

Litecoin price displays convincing evidence that a countertrend rise could occur. Key levels have been defined to interpret LTC's potential move.

Cardano price shows strong bearish signals to start the new year. ADA could fall below $0.20 if market conditions persist.

The crypto market produced mundane price action to close out 2022, as all three cryptocurrencies evaded the anticipated Santa Rally. 2023 could be due for more downward price action if the lackluster effort from bulls continues.

Bitcoin (BTC) price is traversing a channel that is sloping to the upside. Despite the consolidation, BTC is slowly climbing higher like clockwork. The recent Federal Open Market Committee (FOMC) Meeting on December 15 caused BTC to spike beyond the confines of the channel, but things are back to normal.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.