Get in the KNOW

on LA Startups & Tech

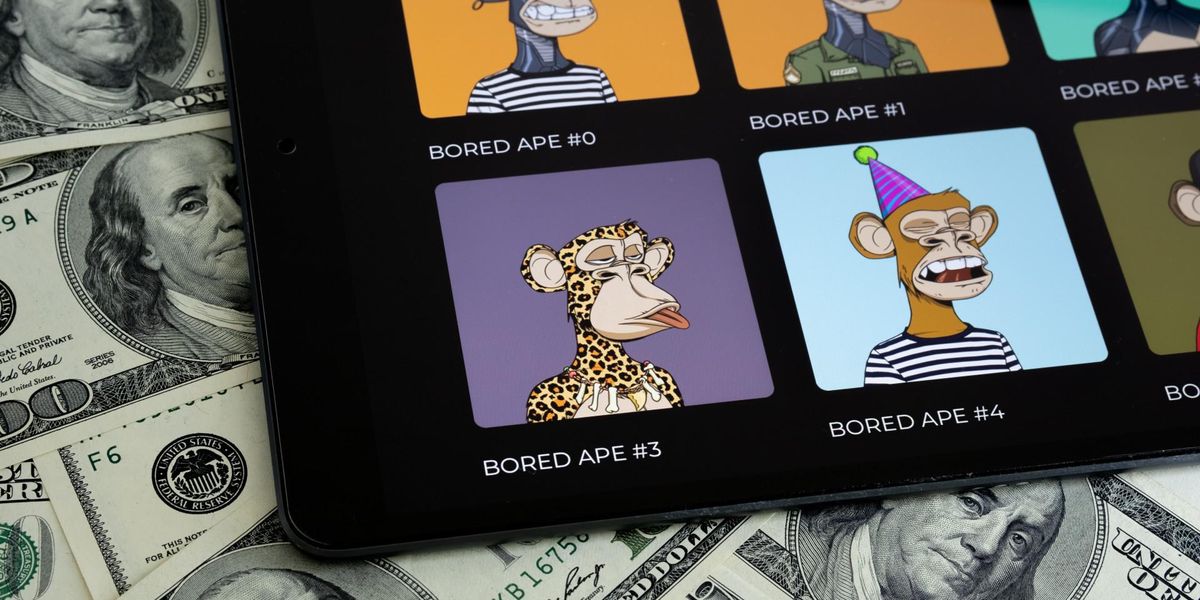

Celebs, like everyone else, just want to be in on what’s cool and new. In the last five to six years, that’s been cryptocurrency and NFTs. It’s a new frontier in celebrity shilling for products, but it’s not as straightforward as just holding up a favorite can of beer and saying it tastes great. The blockchain holds risks for everyone, and when you’re famous, the costs of taking those risks could get out of hand very quickly.

Seventeen famous names found that out in early August 2022. That’s when consumer watchdog group Truth in Advertising (TINA) sent letters to a diverse group that included A-listers like DJ Khaled, Eminem, Gwyneth Paltrow, and Tom Brady. Each letter was tailored to its recipient but included the following statement:

While TINA.org is not currently addressing a specific deceptive marketing issue pertaining to such posts, we have found that celebrity NFT promotions is an area rife with deception, including, but not limited to, a failure to clearly and conspicuously disclose the promoter’s material connection to the endorsed NFT company, as well as the omission of other material information, such as the risks associated with investing in such speculative digital assets, the financial harm that can result from such investments, and the personal benefit(s) the promoter may gain by virtue of the promotion(s).

The letter advised celebs that they were required to disclose a financial connection to whatever NFT collection they promoted and then singled out Justin Bieber and Reese Witherspoon. TINA was onto the connection between the former’s inBetweeners NFTs and the latter’s connection with World of Women NFTs.

The letter sent to Reese Witherspoon was blunt. It linked tweets the actor had posted about World of Women NFTs in 2021 and 2022 and stated that the Federal Trade Commission (FTC) "requires that social media influencers such as Ms. Witherspoon clearly and conspicuously disclose when they have any financial, personal, or other material relationship with a brand.”

Witherspoon, the letter read, “markets an NFT company (in which she has a personal stake) without ever disclosing the risks associated with investing in such speculative digital products, and the financial harm that can result from such investments.” That lack of transparency, TINA’s letter concluded, “is particularly important in light of Ms. Witherspoon’s widespread popularity among fans of varying degrees of financial experience.”

As an August 8 BuzzFeed report about the notifications pointed out, even celebrities who buy a Bored Ape out of pocket are “essentially pumping the value of their own investment” when they do anything to promote the collection, like posting an image on Instagram.

TINA’s warning letters were an important heads up for stars who don’t want to run afoul of the Federal Trade Commission. TINA’s warnings have often preceded the FTC filing legal action, known as a “Notice of Penalty Offenses Concerning Deceptive or Unfair Conduct around Endorsements and Testimonials.” Most celebrities would rather not get hit with the kinds of substantial fines the government can levy for unfair or deceptive practices.

A few months before the bulk of TINA’s letters went out, actor, writer, and ‘Robot Chicken” co-creator Seth Green discovered another danger of that blockchain life: There are legal gray zones galore.

Green had purchased a few Bored Apes (BAYC), including #8398, which he dubbed Fred Simian. Not long after he went on his shopping spree, Green fell for an old-fashioned phishing scam—he responded to a message that ultimately prompted him to enter his OpenSea login information, and in short order, some of his most valuable NFTs were transferred to the wallet of one “Mr Cheese.”

The actor was desperate to get his property back, tracking down Mr Cheese’s likely Twitter account and posting public messages asking for Fred’s return. It turned out that Green wasn’t just running a Twitter account for Fred Simian—by acquiring the copyright to Fred with his purchase, Green was building an entire mixed animation and reality sitcom, “White Horse Tavern,” around the character.

White Horse Tavern @Veecon with Seth Green and Garyvee

In the end, blockchain records indicate an account associated with Green’s known buying history was used to repurchase Fred Simian, this time for nearly $300,000.

Had Green taken the case to court, it wouldn’t have been easy for him. The blockchain was designed for anonymous transactions, and it can be hard enough for law enforcement to investigate crimes online in the first place—add in cryptocurrency security and the result can be a bit of a nightmare even for seasoned online sleuths.

Seth Green’s Bored Ape ordeal was perhaps a bit more straightforward than concerns over celebrity disclosures putting the likes of Gywneth Paltrow and Jimmy Fallon in the FTC’s crosshairs. Non-famous people buy NFTs and trade crypto daily, frequently confronting phishing attacks. What happened to him happens to a lot of consumers—the FTC reported in June this year that scammers had taken in a billion dollars since January alone.

TINA’s warning letters and Seth Green’s adventures in BAYC-land are just two aspects of cryptocurrency complexity. Famous folks face other challenges when they get into crypto in some form—challenges that have more to do with PR than the law. During Super Bowl LVI in February 2022, Matt Damon and Larry David appeared in high-profile, expensive commercials for the crypto.com and FTX exchanges.

Both spots received plenty of notice on social media at the time, but in June 2022 crypto winter began. Damon’s and David’s became fodder for bitter jokes from those losing money in the tanking market and sources of schadenfreude for crypto skeptics.

The ads seemed to vanish from regular rotation pretty quickly, so it’s likely the reputational damage to either star was minimal in the long run—and after all, Matt Damon and Larry David were obviously paid spokespeople.

In a recent article for Law 360, attorneys Amy Mudge and Lauren Bass of national law firm Baker & Hostetler LLP discussed Truth in Advertising’s letters to celebrities about their lack of disclosures. Mudge and Bass acknowledged that while TINA’s letters reflected frustration with “the lack of aggressive enforcement of individual influencers,” the FTC is likely taking the right approach to these issues on its own. The government agency has published guidelines for influencers in plain, non-legalistic language and has generally taken an educational approach rather than aggressively issuing warnings.

Mudge and Bass write that the FTC’s “focus on education rather than reprimand is arguably a smarter use of the agency's limited resources. This approach has helped to increase awareness of responsibilities as well as overall compliance by brand marketers, influencers and even social media platforms.”

Still, the attorneys have some free advice for celebs still interested in an NFT collab.

“Regardless of the product or medium in which such endorsement takes place,” Mudge and Bass write, “remember to follow federal guidelines regarding endorsements and to clearly and conspicuously disclose the relationship of the parties along with the potential volatility of any digital asset investment.”

Be clear about it if you get paid to tell others to invest in new, still unfamiliar assets. The world of crypto is shady enough as it is.

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

When avatar startup Genies raised $150 million in April, the company released an unusual message to the public: “Farewell.”

The Marina del Rey-based unicorn, which makes cartoon-like avatars for celebrities and aims to “build an avatar for every single person on Earth,” didn’t go under. Rather, Genies announced it would stay quiet for a while to focus on building avatar-creation products.

Genies representatives told dot.LA that the firm is now seeking more creators to try its creation tools for 3D avatars, digital fashion items and virtual experiences. On Thursday, the startup launched a three-week program called DIY Collective, which will mentor and financially support up-and-coming creatives.

Similar programs are common in the startup world and in the creator economy. For example, social media companies can use accelerator programs not only to support rising stars but to lure those creators—and their audiences—to the company’s platforms. Genies believes avatars will be a crucial part of the internet’s future and is similarly using its program to encourage creators to launch brands using Genies’ platform.

“I think us being able to work hands on with this next era—this next generation of designers and entrepreneurs—not only gets us a chance to understand how people want to use our platform and tools, but also allows us to nurture those types of creators that are going to exist and continue to build within our ecosystem,” said Allison Sturges, Genies’ head of strategic partnerships.

DIY Collective’s initial cohort will include roughly 15 people, Sturges said. They will spend three weeks at the Genies headquarters, participating in workshops and hearing from CEOs, fashion designers, tattoo artists and speakers from other industries, she added. Genies will provide creatives with funding to build brands and audiences, though Sturges declined to share how much. By the end of the program, participants will be able to sell digital goods through the company’s NFT marketplace, The Warehouse. There, people can buy, sell and trade avatar creations, such as wearable items.

Genies will accept applications for the debut program until Aug. 1. It will kick off on Aug. 8, and previous experience in digital fashion and 3D art development is not required.

Sturges said that the program will teach people “about the tools and capabilities that they will have” through Genies’ platform, as well as “how to think about building their own avatar ecosystem brands and even their own audience.”

Founded in 2017, Genies established itself by making avatars for celebrities from Rihanna to Russell Westbrook, who have used the online lookalikes for social media and sponsorship opportunities. The 150-person company, which has raised at least $250 million to date, has secured partnerships with Universal Music Group and Warner Music Group to make avatars for each music label’s entire roster of artists. Former Disney boss Bob Iger joined the company’s board in March.

The company wants to extend avatars to everyone else. Avatars—digital figures that represent an individual—may be the way people interact with each other in the 3D virtual worlds of the metaverse, the much-hyped iteration of the internet where users may one day work, shop and socialize. A company spokesperson previously told dot.LA that Genies has been beta testing avatar creator tools with invite-only users and gives creators “full ownership and commercialization rights” over their creations collecting a 5% transaction fee each time an avatar NFT is sold.

“It's an opportunity for people to build their most expressive and authentic self within this digital era,” Sturges said of avatars.

The company’s call for creators could be a sign that Genies is close to rolling out the Warehouse and its tools publicly. Asked what these avatar tools might look like, the startup went somewhat quiet again.

Allison Sturges said, “I think that's probably something that I'll hold off on sharing. We will be rolling some of this out soon.”

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

LA Tech Week—a weeklong showcase of the region’s growing startup ecosystem—is coming this August.

The seven-day series of events, from Aug. 15 through Aug. 21, is a chance for the Los Angeles startup community to network, share insights and pitch themselves to investors. It comes a year after hundreds of people gathered for a similar event that allowed the L.A. tech community—often in the shadow of Silicon Valley—to flex its muscles.

From fireside chats with prominent founders to a panel on aerospace, here are some highlights from the roughly 30 events happening during LA Tech Week, including one hosted by dot.LA.

DoorDash’s Founding Story: Stanley Tang, a cofounder and chief product officer of delivery giant DoorDash, speaks with Pear VC's founding managing partner, Pejman Nozad. They'll discuss how to grow a tech company from seed stage all the way to an initial public offering. Aug. 19 at 10 a.m. to 12 p.m. in Santa Monica.

The Founders Guide to LA: A presentation from dot.LA cofounder and executive chairman Spencer Rascoff, who co-founded Zillow and served as the real estate marketplace firm’s CEO. Aug. 16 from 6 p.m. to 9 p.m. in Brentwood.

Time To Build: Los Angeles: Venture capital firm Andreessen Horowitz (a16z) hosts a discussion on how L.A. can maintain its momentum as one of the fastest-growing tech hubs in the U.S. Featured speakers include a16z general partners Connie Chan and Andrew Chen, as well as Grant Lafontaine, the cofounder and CEO of shopping marketplace Whatnot. Aug. 19 from 2 p.m. to 8 p.m. in Santa Monica.

How to Build Successful Startups in Difficult Industries: Leaders from Southern California’s healthcare and aerospace startups gather for panels and networking opportunities. Hosted by TechStars, the event includes speakers from the U.S. Space Force, NASA Jet Propulsion Lab, Applied VR and University of California Irvine. Aug. 15 from 1 p.m. to 5 p.m. in Culver City.

LA Tech Week Demo Day: Early stage startups from the L.A. area pitch a panel of judges including a16z’s Andrew Chen and Nikita Bier, who co-founded the Facebook-acquired social media app tbh. Inside a room of 100 tech leaders in a Beverly Hills mansion, the pitch contest is run by demo day events platform Stonks and live-in accelerator Launch House. Aug. 17 from 12:30 p.m. to 3 p.m. in Beverly Hills.

Registration information and a full list of LA Tech Week events can be found here.

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

Investor Blake Bartlett spent high school exploring different passions, from skateboarding to photography.

He now sees himself as the “song and dance man” at OpenView Venture Capital, a growth-stage venture capital firm. On this episode of the LA Venture podcast, the L.A.-based VC talks about coining the term “product-led growth” and building companies in the “end user age.”

OpenView is currently investing from its sixth fund. Focused on B2B software, the firm invests in companies that are actively scaling up, usually around the Series A or Series B, Bartlett said. Based in Boston, the firm has led investments in startups including Calendly, Expensify and Highspot, among others.

OpenView’s “value-add,” he said, is its 75- to 80-member expansion team, which focuses on helping its portfolio companies grow.

While many investors have a reputation for being interested mainly in metrics and math, Bartlett prides himself on bringing imagination to his investing approach.

“I'm much more wired like a creative,” Bartlett said. “Creativity means lots of different things. Creative problem solving, and how do we sort of really have a unique angle to diligence and this investment thesis like that is creativity, and that certainly comes to bear, but also having other outlets.”

Currently, he also uses that vision through his YouTube series, “PLG123,” and his podcast, “Build.” Both allow him to explore finding his voice and presenting a unique perspective to a wider audience by discussing topics relevant to the VC community.

That creativity came into play in 2016, when he noticed more companies were using product development—rather than sales or marketing—to grow. These companies were different both in operation and performance, Bartlett said, and were expanding quickly without burning capital.

“These businesses were growing incredibly fast on the top line, and then also being capital efficient, if not profitable on the bottom line,” Bartlett said. “For me, that kind of broke the fundamental rules of physics of startups, because I had heard and been taught that there's a fundamental trade off more times than not—almost all the time—between growth and profitability.”

Where a traditional business might invest heavily in its sales and marketing teams in order to expand, Bartlett said, a product-led organization looks first at tactical problems and seemingly small details like signup processes, paywalls and other features. These types of startups were building their product to serve the end user, rather than the division lead who might be purchasing software for a large company, for instance.

“So it's a difference first and foremost, the building for the user, not for the buyer. And then you distribute it to the user, not to the buyer.”

Bartlett said one of the benefits of this model is that companies can build a user base before dealing with administrative issues that software companies have to deal with when selling to much larger companies. Instead, product-led companies can focus on how to turn individual users’ love for a product into revenue, and then scale it from there.

“What is the business case and how do we take all this user love and this thing that people say they can't live without, how do we articulate that into ROI in dollars and cents for this organization that's considering [purchasing in] six figures, seven figures or something of that nature?” Bartlett said.

dot.LA editorial intern Kristin Snyder contributed to this post.

Click the link above to hear the full episode, and subscribe to LA Venture on Apple Podcasts, Stitcher, Spotify or wherever you get your podcasts.

© dot.LA All rights reserved