Ethereum is the second-largest cryptocurrency by market capitalization. It’s the biggest altcoin, and it went on a massive bull run in 2021, reaching its all-time high (ATH). The coin has made new lows since then, but the project’s future has given investors hope of another price spike.

In this guide, we make an Ethereum price prediction based on the coin’s history and the potential for future projects. We’ll also show you how to invest in Ethereum with low trading fees.

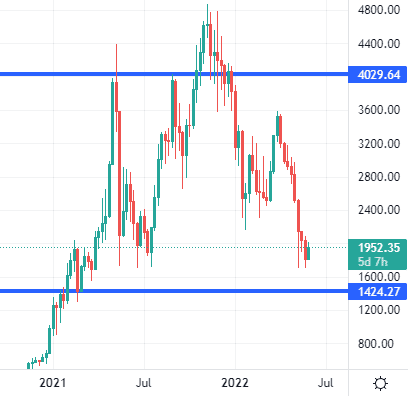

Ethereum’s price has ranged since the beginning of May 2022 from $1,700 to $2,300. The current Ethereum price is $1,970, but ETH has tremendous upside potential, which we’ve highlighted in our Ethereum multi-year forecast.

Cryptoassets are a highly volatile unregulated investment product.

Is Ethereum a good investment? When Bitcoin resumed its bull run at the end of 2020, Ethereum followed suit. Most altcoins were stagnant, but Ethereum’s expanding use case made investors see its tremendous potential. Most investors didn’t expect Ethereum (ETH) to surge as high as it did, but it went more than 2x from the ATH set in 2018. Since ETH has experienced high volatility, let’s look at its history.

In 2013, programmer Vitalik Buterin developed Ethereum. The development work and crowdfunding began in 2014, and the network was live the following year. Ethereum is an open blockchain with smart contract functionality, home to digital money, global payments and applications. Buterin also ensured that the platform allowed people to build decentralized applications (DApps). We found several great DApps to invest in for the future.

Ethereum ranged throughout 2015, but it had a massive spike from the beginning of the following year. Investors enjoyed a bull run of 1,300% from just over $1 to $15.20 from January to March 2016. A significant correction followed, with the price losing more than half of its value and ETH closing off the year at just over $8.

From January until March 2017, Ethereum’s price consolidated. But a spike followed in March 2017, then further upside followed when the price reached $53 in April. The price continued surging for the rest of 2017, encountering significant retraces of 40%. But that didn’t stop Ethereum from reaching a new ATH of $1,430 in January 2018.

After the ATH in 2018, Ethereum entered a multi-year bear market. During the global lockdowns in March 2020, the coin plummeted to $97. At the time, investors were in extreme fear, but the dip was temporary, as Ethereum made a V-bottom and began climbing in September 2020 to $481.

The price ranged until the end of November 2020. Ethereum’s price began surging in December, then topped out at $4,300 in May 2021, making a new ATH. Investors who got in during March 2020 enjoyed a 4,600% bull run. But that wasn’t the end of it. Although Ethereum lost 60% of its value after setting an ATH, it surged again to make a new ATH at $4,840 in November 2021.

Since setting an ATH, Ethereum has been in a downtrend. It lost 64% of its value, reaching $1,715 in May 2022. We saw a slight spike in price at the end of May, but further downside is possible. That would make sense because the crypto market has shown that it tends to retest its previous highs. By dipping to $1,400, Ethereum will retest the high it set in January 2018.

Predicting the price of any asset is difficult, especially for one in a volatile market such as cryptocurrency. Knowing volatility is likely in crypto can be good news for investors after witnessing their portfolio drop by more than 60%.

That’s what Ethereum did after reaching its ATH in November 2021. The price has been setting new lows for the last six months, hovering around $1,900 in May 2022. But more bad news is on the horizon. We’ve seen crypto prices retest their previous ATHs. For Ethereum, that means a further drop to around $1,400.

It’s at that level that the price will find strong support. Investors shouldn’t be surprised to see that level hold, since it has for over a year. If that level holds, our Ethereum price prediction 2022 will bounce up to $4,000, where it will encounter strong resistance, by the end of the year.

The Ethereum team has been working to transition the platform to second-generation updates. Transitioning the platform to Ethereum 2.0 could make Ethereum more affordable to mint. Users will be able to develop products at lower service fees than the current exorbitant prices.

It’s going to take more than sentiment for the price to break through the $4,000 region. Ethereum has faced competition from platforms offering similar features but with lower fees.

Making a long-term prediction for Ethereum’s price means looking at the fundamentals. The more adoption Ethereum gets, the more likely it is for the price to rise. When the price reaches resistance at around $4,000, a catalyst event is one way that the price will break through that level. That could be the launch of Ethereum 2.0.

The result is a platform that supports 1000s of transactions per second, cheaper transactions and faster applications. A part of the developments includes making Ethereum more secure to counter attacks. It’s also their intention to ensure that Ethereum is more sustainable for the environment. The current technology uses a lot of computing power and energy.

These factors will be crucial to integrate into the Ethereum network before it becomes mainstream. The launch of such a platform will increase Ethereum’s user base, potentially seeing more retailers adopting the network and institutional investors putting money into it.

That will catapult the price of Ethereum to its November 2021 ATH, and it will break through that resistance. The most likely thing to happen after the breakthrough is a retest of the new support that will form at around $4,840. The coin will continue to surge and make a new ATH, probably topping out at around $6,000.

Apart from the potential update to Ethereum 2.0, many non-fungible tokens (NFTs) are held on the Ethereum blockchain. The NFT market expanded rapidly in the last few years, with some NFTs selling for millions of dollars. Further expansion to the NFT market means more adoption of Ethereum and a higher price.

The Ethereum price chart showed that what goes up, must come down. After every bull run, the crypto market has entered a multi-year bear market. Since the inception of Bitcoin in 2009, we had three major bull runs: 2013, 2017 and 2021. We’re expecting a blow-off top in the next year, then the coins will reach new ATHs.

After the crypto market reaches the top, history has shown that the price makes lower lows for the subsequent few years. Sure, retracements happen along the way, and investors get caught wrong-footed thinking it’s a pump, but those moves are part of a bear market.

So what will happen to the ETH price in a bear market? It’s difficult to determine the exact year that Ethereum will bottom in the coming bear market, but 2025 seems likely to be a year of the bear in crypto.

The crypto bear market history revealed that the price reaches several support levels, breaking through most of them. For Ethereum, it means going back down to the $1,400 region (2018 ATH). If investors think that’s agony, they should brace for further downside.

In crypto bear markets, most coins crash by 90%. If Ethereum reaches a new ATH of $6,000, it will drop to $600. That might seem impossible, but ETH lost 94% value in March 2020 after its 2018 ATH.

A crypto winter can be brutal, so buying Ethereum at the top means losing most of its value. Then, you have to wait several years for the price to reach that level again.

Some analysts predict that Ethereum will reach $12,000 by 2025. That will mean that the Ethereum bull run will last for at least four years, since it started in 2021. Anything is possible, but we have to use the history of the crypto market to base our decision. And the crypto market has never been in a four-year bull run and without massive crashes.

Volatility is in Ethereum price’s history, so we expect more of it in the next few years. Based on technical and fundamental factors, we’ve identified key Ethereum price levels.

Some crypto newbies believe that most cryptocurrencies are the same. It’s the use case that separates them, and since Ethereum is the second-biggest coin, many users have adopted it for several reasons. Some investors even earn interest on Ethereum.

Otherwise known as DeFi, decentralized finance enables users to make financial transactions using blockchain networks. Ethereum enables peer-to-peer payments without relying on third parties such as exchanges, banks or brokerages.

The DeFi market is always open, and users can send money globally, trade tokens and buy insurance. You can buy also buy DeFi tokens.

Ethereum transaction fees depend on several factors. It’s usually more than $3, but the fee did drop to $1.56 recently. That might not sound a lot, but if your transaction is $10, those fees are 20% or more.

Ever wondered how to spend Ethereum? Videos, art and music have become digitalized via NFTs. They’re tokens attached to assets, giving them value. NFTs have become extremely popular, and numerous celebrities endorsed and own them.

The NFT market was worth $41 billion in 2021 and poised for a $147 billion growth until 2026. NFTs are secured on the Ethereum blockchain and have only one owner. They’re compatible with anything built on Ethereum’s platform. A broader NFT market means more Ethereum adoption. Several places are available for you to buy NFTs.

Also known as DAO, decentralized autonomous organizations use smart contracts to make collaborative decisions across networks. DAO members own and govern them, and they have built-in treasuries accessible only once the group grants permission.

The DAO codes consist of rules that govern their spending, and they’re completely transparent. Decisions are made by voting and proposals to ensure that all members have a voice. Votes are tallied automatically—the same way in a democratic system. No third party is involved in handling the votes.

Examples of DAO projects include fundraising for charities and ventures.

Some crypto sceptics believe that Ethereum’s price is driven solely by speculation. We’ve seen that happen, but several factors have consistently determined price fluctuations and influenced an ETH price prediction.

Thanks to NFTs, struggling artists have digitalized their work, and some have made a fortune. Ethereum’s smart contracts have made that possible, resulting in a spike in users. Since more people are joining Ethereum’s platform for transacting, its wallets and price have increased.

First-mover advantage is similar to brand loyalty. Ethereum holders have ensured their coin’s positioning in the market by using only it, even if cheaper and faster alternatives exist. Ethereum’s community buy-in could ensure that the coin maintains its value in the near future but rises in the long term.

Ethereum’s rise in popularity has made its transaction fees expensive. The other problem Ethereum faces is the massive power and energy necessary to transact. It’s damaging to the environment.

Competitors have stepped in and created add-on solutions to Ethereum’s blockchain, making it more efficient and cheaper. Luring customers away from Ethereum could lessen its value.  The best option to buy Ethereum is with a regulated broker. Using eToro, you can invest in Ethereum and 65 other cryptocurrencies.

The best option to buy Ethereum is with a regulated broker. Using eToro, you can invest in Ethereum and 65 other cryptocurrencies.

Security is important to investors, so eToro ensures that it holds cryptocurrencies in a secure wallet. The platform has also reassured clients it abides by the highest financial standards, so it sought regulation by FINRA and the SEC in the US and other international organizations such as FCA, CySEC and ASIC

eToro has made crypto investing sociable. It offers CopyTrade, enabling you to mimic the strategies and trades of top traders. Users can communicate with traders to learn and socialize. The platform has made investing convenient.

Investors can use Smart Portfolio. It’s similar to investing in a Bitcoin ETF, enabling portfolio diversification. Thematic Market Portfolios is one of the strategies available for a Smart Portfolio. The minimum investment is only $500, and investors choose several assets to make up a portfolio. The best part about this investment strategy is that it doesn’t come with a management fee, and it’s rebalanced periodically to ensure optimal returns.

Investors buying crypto in eToro will incur a 1% fee, which is added to the market price. Depositing money into an eToro account is free, but a withdrawal incurs a $5 charge. Inactive traders will be charged $10 after 12 months of inactivity. Some of the options for funding an account are debit/credit cards, Skrill, Paypal, Neteller, bank wire, Rapid Transfer, Ideal, Poli and several others.

Day-trading crypto is also available on eToro’s platform. Beginners will find it simple to use, but it contains advanced tools that expert traders can incorporate into their strategies. Traders who want to test out the platform before depositing money can try out the $100,000 demo account for free. Besides trading crypto, investors can also buy stocks on eToro. for 0% commissions.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

Ethereum has shown its dominance in the altcoin market by maintaining its position as the second-biggest coin. It has several use cases, and more adoption is in the near future, especially with the launch of Ethereum 2.0.

But Ethereum isn’t the only blockchain project that’s shown to have great utility. Another one we found set up for massive adoption is Lucky Block. It’s a crypto lottery platform built on Binance Smart Chain (BSC). The developers made the platform transcend borders, allowing people around the world to enter lotto draws.

Through the use of LBLOCK, Lucky Block’s native token, the platform can host daily prize draws by allowing users to buy lotto tickets. But the draws aren’t the only way token holders can win. LBLOCK holders receive dividend payments to their wallets by holding tokens. The dividend distributions are based on the number of ticket holders. We’ve made a Lucky Block price prediction.

Through the use of LBLOCK, Lucky Block’s native token, the platform can host daily prize draws by allowing users to buy lotto tickets. But the draws aren’t the only way token holders can win. LBLOCK holders receive dividend payments to their wallets by holding tokens. The dividend distributions are based on the number of ticket holders. We’ve made a Lucky Block price prediction.Investors who bought LBLOCK in February 2022 watched it pump more than 1,100% in two weeks. Since reaching an ATH, LBLOCK has been in a downtrend. After it bounced off key support, LBLOCK spiked 266%.

It’s easy to buy LBLOCK. Our simple steps will help you get started right away.

Next 10x Crypto – Lucky Block (LBLOCK)

- Listed on LBank, Pancakeswap – Trending in 2022

- Crypto Games Platform – luckyblock.com

- Donations to Charity

- Free Ticket to Jackpot Draws

- Passive Income Rewards

- Worldwide Competitions

- 10,000 NFTs Minted – nftlaunchpad.com

Conclusion

Next 10x Crypto – Lucky Block (LBLOCK)

Our Rating

Our Ethereum price prediction was based on technical and fundamental analysis, as well as incorporating macroeconomic factors that could have a significant impact on the price. Ethereum is retracing to key support, but a bounce of it, followed by another bull run, is on the cards. The development of Ethereum 2.0 and the platform’s rise in popularity have swung investor sentiment to bullish.

An alternative to Ethereum that could potentially be an investment is LBLOCK. Investors who bought the coin in February 2022 experienced a massive pump of 1,100% in just two weeks. Coin holders also receive dividends, which are determined by the number of lottery ticket holders. Not only can you profit from the coin’s surge, but dividend distribution could be another form of income from LBLOCK.

Cryptoassets are a highly volatile unregulated investment product.

Price action suggests that a pump of Ethereum would result in it finding resistance at $4,000.

The Ethereum price today is $1,968.

The price at the 2015 launch found support at $0.32 before surging a few months later.

It’s possible that Ethereum could enter a bear market in 2025 after setting a new ATH and retest $1,400.

Certain experts have an Ethereum forecast of $12,000 in 5 years.

Some analysts predict a $25,000 Ethereum crypto price.

Ethereum reached an all-time high of $4,840 in November 2021.

This article was written for Business 2 Community by Anthony Layton.

Learn how to publish your content on B2C

Anthony has an interest in the latest SEO, digital media and marketing trends, working as a content writer in those disciplines.… View full profile ›

Join over 100,000 of your peers and receive our weekly newsletter which features the top trends, news and expert analysis to help keep you ahead of the curve

Note that the content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This website is free for you to use but we may receive commission from the companies we feature on this site.