anilakkus

anilakkus

When most people say, “I hate to say, ‘I told you so,'” let’s face it…

They don’t really mean it. They’re actually delighted to get their “Nayah, nayah, nayah, I was right, and you were wrong” in.

It’s really obnoxious.

I say that as someone who’s been on the receiving end of the jab and on the self-righteous side. (Hasn’t every parent?) In this case, though, there’s no smugness involved. I genuinely hope you listened to me when I said to avoid:

I know they all have their individual and collective appeals – from the fear of missing out (“FOMO”) to wanting to be one of the cool kids to the allure of fast gains. I’ve fallen for such things before, which might be why I’m not going to say, “I told you so.”

Been there. Done that. Felt the pain.

In fact, it was experience with such get-rich-quick, feel-good-in-the-moment schemes that have me where I am today. That’s why I’ve made my life’s mission to guide others away from such fates.

So trust me when I say I’m not gloating when I point out that I told you to avoid these assets. For those who followed, hopefully, this will inspire you to continue investing wisely.

And for those who didn’t, hopefully, this will help you avoid such mistakes in the future.

It’s been a while since I dedicated an article to cryptocurrencies. Maybe that’s because they’ve lost significant luster since last June.

I think that was when my son – who is very intelligent, but very much a part of Gen Z – was very much trying to convince me that crypto and NFTs were a worthwhile venture. In which case, he was really doing a great job of presenting his case.

That’s how I came to write “Crypto Today Seems Like REITs in the 1970s” the day before. It featured these summary points:

In other words, I could see the asset class’s potential. But it remained too unestablished to be free of kinks and kooks.

I’m even less willing to give cryptocurrency the benefit of the doubt. You can get the gist of my thoughts on it from my November 2021 article, “Become an NFT Landlord and Sleep Well at Night.”

Contrary to what the title implies, I had a whole segment titled,

“Explaining NFTs and Why I Object to Them.”

The next segment was “A Personal Story About an NFT Equivalent (Back in My Day).” It told the story of when:

“I thought I was a real estate mogul, renting out jet planes and taking fancy vacations to luxurious resorts.

“I was making lots of money from the buildings I built – and far too often spending it just as quickly. There were far too many perks I enjoyed on funds that should have been being wisely invested instead…

“For instance, I sold a shopping center in 2004, which gave me about $400,000 to put in the bank. I soon used about $250,000 of that to buy up a franchised Athlete’s Foot location. And another $92,000 went toward purchasing a diamond ring for my wife.”

Neither of which I researched.

As such, I can’t take credit for the fact that the diamond ring actually ended up being a worthwhile investment (worth over $250k today). That was sheer luck.

Athlete’s Foot, meanwhile, is “almost defunct in the U.S. today.” My stores definitely are, as is that $250,000 investment.

As I said in the beginning, that’s why I’m so risk-averse today. It’s not that I’m unwilling to be daring.

I can be as bold as the next guy, believe it or not. If I could disclose details about the projects I’m working on today, you’d easily recognize that.

But that boldness needs to be backed by brains.

This means no buying into sucker yields, value traps, or new-fangled notions without knowing about them first.

Yesterday I was speaking with a group of high-net-worth investors, and I was telling them that I consider now the best time in my lifetime to own real estate investment trusts (“REITs”).

These friends are all sophisticated investors who have built incredible wealth investing in private real estate, and I told them that:

“I have lived through multiple recessions and a global pandemic, and given what I’m seeing right now, you should load up on publicly-traded REITs.”

I went on to say that:

“Mr. Market is completely ignoring the fact that REITs grow earnings and dividends, and while there is certainly risk related to inflation and rising rates, most of the higher quality REITs have stress tested these forces and are well-positioned to generate reliable dividend growth in the years to come.”

Personally, I am taking advantage of the mispricing and increasing my exposure to REITs, recognizing that I have the potential to speed up my retirement plans.

I’m now in the best shape I’ve ever been in my entire life – physically, mentally, and financially – and the next year or two could add meaningful fuel to my eventual retirement.

Here are a few REITs I’m buying…

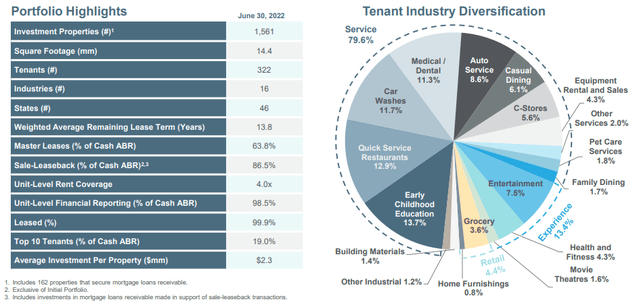

Essential Properties Realty Trust, Inc. (EPRT) is a net lease REIT that has a portfolio of 1,572 free-standing properties (14.8 million square feet) in 48 states. The diversified portfolio is leased to tenants in businesses such as restaurants (including quick service, casual and family dining), car washes, automotive services, medical services, convenience stores, entertainment, health & fitness, and early childhood education.

EPRT Investor Relations

EPRT Investor Relations

The healthy portfolio is 100% occupied with a weighted average embedded escalators of 1.5% per year with solid coverage: unit-level coverage of 4.2x with 99% of ABR required to report unknit-level P&Ls.

EPRT’s balance sheet is positioned to fund external growth opportunities as the company maintains low leverage: Net Debt/Annualized EBITDAre of 4.4x, and a weighted average debt maturity of 5.7 years.

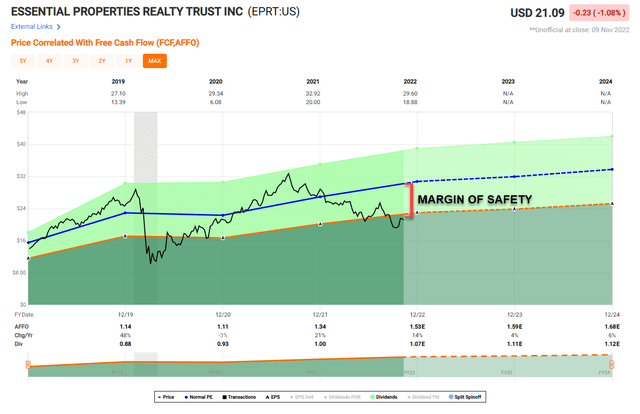

In Q3-22, EPRT generated adjusted funds from operations (“AFFO”) per share of $0.38, an increase of 15% versus Q3-21. Over a nine-month period, AFFO was $1.15 per share on a fully diluted per share basis, which is a 19% increase over the same period in 2021.

EPRT maintained its 2022 AFFO per share guidance range of $1.52 to $1.54, which implies a 14% year-over-year growth rate at the midpoint.

EPRT Investor Relations

EPRT Investor Relations

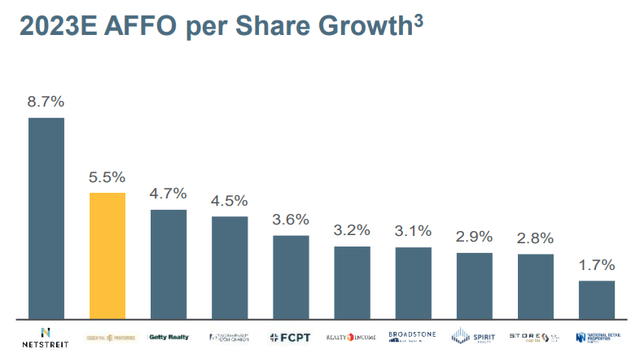

The company issued AFFO per share guidance for 2023 at a range of $1.58 to $1.64, which implies a 3% to 7% growth at the low and high ends of the range, relative to the midpoint of the 2022 AFFO per share guidance.

As viewed below, EPRT is trading at a wide margin of safety – based upon the current price of $21.09 and P/AFFO of 14.0x. The normal P/AFFO is 20.1x and the current dividend yield is 5.1%. The payout ratio is just 70%, and iREIT believes shares could fetch $28.00 by the end of 2023 which translates to 30%+ annualized returns.

FAST Graphs

FAST Graphs

Extra Space Storage Inc. (EXR) is another high-quality REIT we’re buying right now.

The Salt Lake City-based REIT is a member of the S&P 500 and owns and/or operates over 2,000 self-storage properties (1,009 owned, 304 JV, and 864 managed), which comprise approximately 1.5 million units and approximately 164 million square feet of rentable storage space.

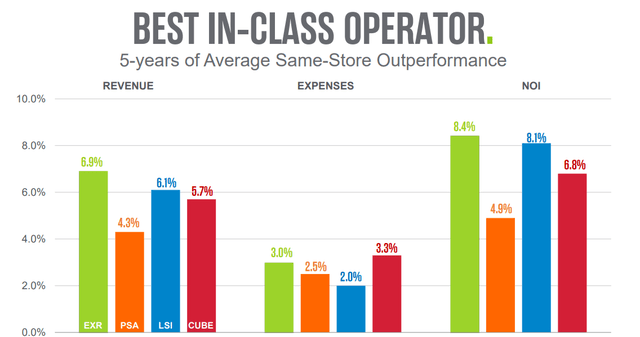

EXR is the second-largest owner and/or operator of self-storage properties in the U.S. and is the largest self-storage management company. It’s considered a best-in-class operator and has gained a reputation as a technology leader in the REIT sector. You can now find Extra Space stores in over 1,000 cities across the U.S.

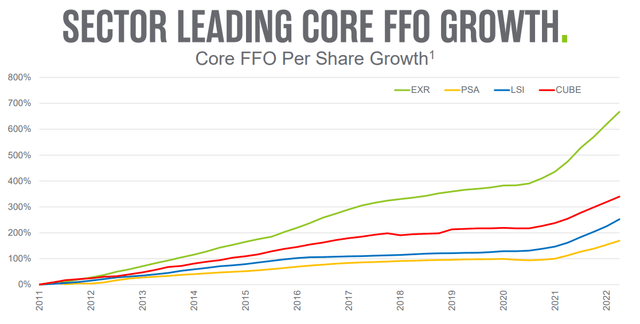

Over the last five years, EXR has outpaced its peers, as viewed below:

EPRT Investor Relations

EPRT Investor Relations

Importantly, EXR has excelled in generating the strongest FFO per share growth:

EPRT Investor Relations

EPRT Investor Relations

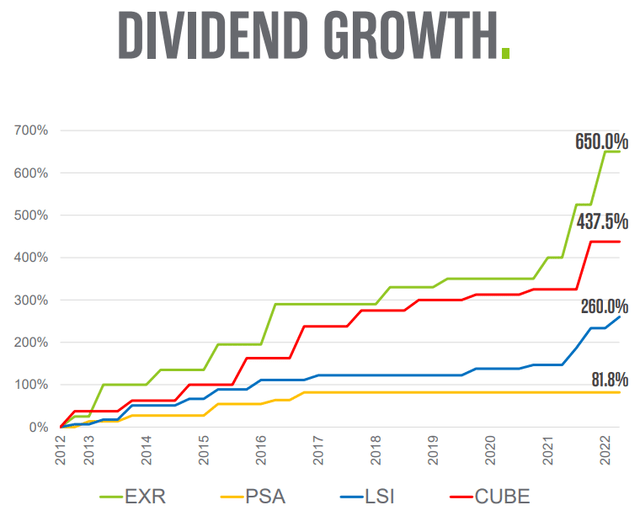

Of course, this has led to best-in-class dividend growth:

EPRT Investor Relations

EPRT Investor Relations

In Q3-22, EXR has strong same-store revenue growth of 15.5%, driven by strong rental rate growth, partially offset by lower year-over-year occupancy. Expense pressure across many line items resulted in total same-store expense growth of 12.6% and same-store NOI growth of 16.4%.

This strong property NOI plus external growth efforts resulted in core FFO growth of 19.5% (includes an add-back of $0.05 per share for estimated property damage and tenant insurance claims related to Hurricane Ian).

EXR’s 2022 implied same-store revenue growth is the highest in the history of the company, and this is on the back of 2021, which was the company’s second-highest revenue growth year. The implied 2022 FFO growth at the midpoint is 21%.

EXR also has a solid balance sheet, with net debt to EBITDA of 4.6x at the end of the quarter. The company increased its acquisition investment guidance to $1.65 billion, all of which is closed or under contract.

EXR tightened the core FFO range, which is now estimated to be between $8.30 and $8.40 per share, an implied increase of approximately 21% year-over-year.

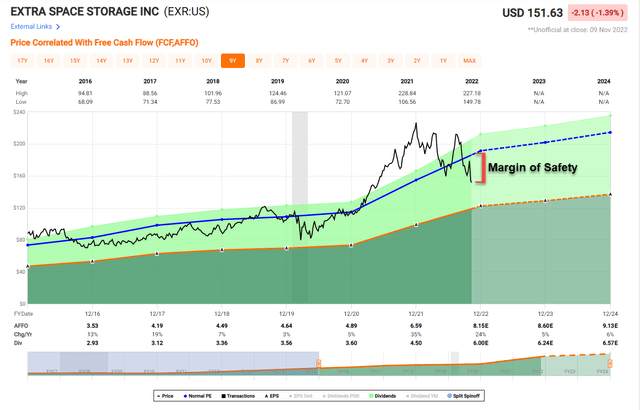

As viewed below, EXR is also trading at a wide margin of safety – shares closed at $151.63 with a P/AFFO of 19.1x. The normal (P/AFFO) multiple is 23.5x, and the current dividend yield is 4.0%.

Given the pullback in pricing, we have become more fixated on this self-storage REIT, which has delivered on its “wide moat” scale and cost of capital advantages. We’re targeting shares to return ~25% over the next 12 months ($19.82 by the end of 2023).

FAST Graphs

FAST Graphs

Remember folks, earnings drive dividends, and dividends drive returns.

It’s as simple as that.

I wish I knew that secret 30 years ago, and if I did, I would not be writing this article right now.

Instead, I would be living an early retirement somewhere, maybe in Paris or Barcelona (I’ll be there in a few weeks).

PS: Possibly Portugal, too (hope to visit my friend and subscriber, Eric).

The good news is that I understand investing now, and I’m happy to share my wisdom with you here on Seeking Alpha. My friend and fellow contributor, Chuck Carnevale, sums it up nicely,

“…if the long-term ownership of great businesses appeals to you as an investor, then you should focus on from where and how your returns will be generated. To me common sense suggests that long-term results will be functionally related to the success of the business being invested in. At the end of the day, often referred to as the bottom line, total returns come down to how profitable the business you choose is and how fast it grows over time.”

And…

“If the company pays a dividend your investment will contain both a capital appreciation and an income component. If the company does not pay a dividend, as an investor you will rely solely on capital appreciation for your total return. In either case, valuation at purchase will greatly impact your long-term total returns.”

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research (“WMR”), a subscription-based publisher of financial information, serving over 6,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha). Thomas is also the editor of The Forbes Real Estate Investor and the Property Chronicle North America.

Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox. He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, and 2019 (based on page views) and has over 102,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley).

Disclosure: I/we have a beneficial long position in the shares of EPRT, EXR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.