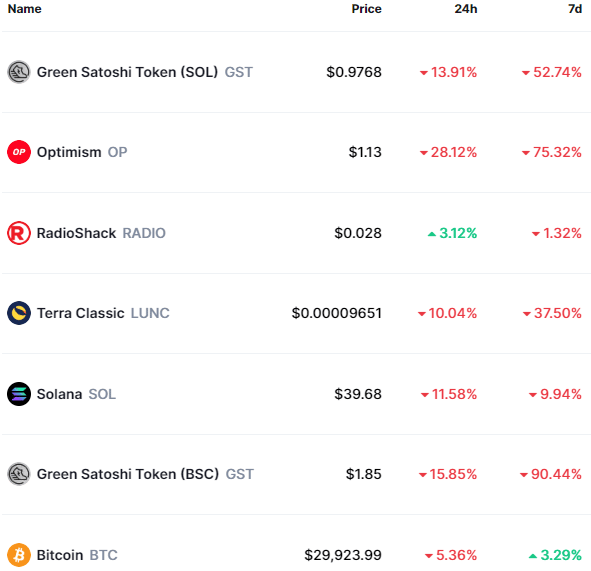

Of the top 7 trending cryptos now on Coinmarketcap – in terms of how many people are checking their price – two are Green Satoshi Token (GST).

Other than Bitcoin, all the most viewed altcoins are also in the red, especially GST over the past week – but what is GST, why is the GST price going down and should you buy GST now?

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

For a background of the STEPN app and its sneaker NFTs, see our move to earn craze post from April.

The STEPN app which allows runners, joggers and walkers to earn free crypto, has a dual-token system with both Green Satoshi Token (GST) and Green Metaverse Token (GMT). Similar to the Step App which has the native token FITFI.

While GMT (also #11 in the trending section) is the governance token of the app, GST is the utility token. Both have value but GST is an inflationary token with an unlimited supply (and an automatic burning mechanism). GST can be used to upgrade and level up sneaker NFTs, or mint new ones, and is the in-game currency earned by users while exercising.

GMT has a fixed total supply of 6 billion and is earned by users who have levelled up their NFT sneakers to level 30, while lower rank users earn GST.

The STEPN app and mobile ‘move2earn’ game runs on the Solana blockchain – the sneaker NFTs required to play are sold on Solana NFT marketplace Magic Eden – where the floor price has dropped to 5.5 SOL from 12 SOL a month ago.

Due to a discrepancy in price between the Solana chain and BSC (the Binance Smart Chain) two tokens now appear on Coinmarketcap to track the price of each.

While things started well for the STEPN app and both its native coins – recently the GMT and GST price has crashed since mainland China banned STEPN – it was announced they would ban STEPN access from July 15th onwards. Move to earn and play to earn games are very popular in Asia – most of the Axie Infinity player base was based in the Philippines.

Some crypto influencers on Twitter such as @AlgodTrading have compared STEPN to a ponzi scheme, suggesting it’s not scalable or sustainable in its current format as a way to earn free crypto, and both the GST and GMT prices could drop.

Algod correctly predicted the Terra (LUNA) crash.

The STEPN developers have stated only 5% of users are Chinese, with others across Asia in places like Thailand and Vietnam that haven’t moved to ban STEPN – so some investors see the current panic sell-off as an overreaction and want to buy STEPN (GMT) or Green Satoshi Token (GST) on the dip.

There are still many venture capital investors involved with STEPN which we detailed in the guides below. Some see the current GMT and GST news as FUD (fear, uncertainty and doubt) and think the price of both STEPN tokens will recover, remaining bullish in the long term.

If you do decide to buy the dip one of the easiest places to buy GST is on Bybit exchange, which has both a GST/USDT spot trading pair and a perpetual futures pair.

GMT, which some prefer to buy due to its fixed supply, is listed on Coinbase.

Next 10x Crypto – Lucky Block (LBLOCK)

Our Rating

This article was written for Business 2 Community by Michael Abetz.

Learn how to publish your content on B2C

Michael has been investing in cryptocurrency since the 2017 bull run, and is a freelance writer producing educational material on decentralized finance topics online.… View full profile ›

Join over 100,000 of your peers and receive our weekly newsletter which features the top trends, news and expert analysis to help keep you ahead of the curve

by Mary Lister

by Shane Jones

by James Scherer

by Brent Carnduff

by Ayo Oyedotun

by Brian Morris

by Ayo Oyedotun

by Jonathan Furman

Thanks for adding to the conversation!

Our comments are moderated. Your comment may not appear immediately.

Note that the content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This website is free for you to use but we may receive commission from the companies we feature on this site.