![]() Ekta Mourya

Ekta Mourya

FXStreet

NFT trade volume rapidly declined on the Ethereum network, with digital art’s contribution to activity on ETH shrinking. Analysts believe NFTs are dominant gas consumers on Ethereum and a decline in volume could fuel bearish sentiment among ETH holders.

Also read: Three reasons why proof-of-work ETH1 will survive Ethereum Merge

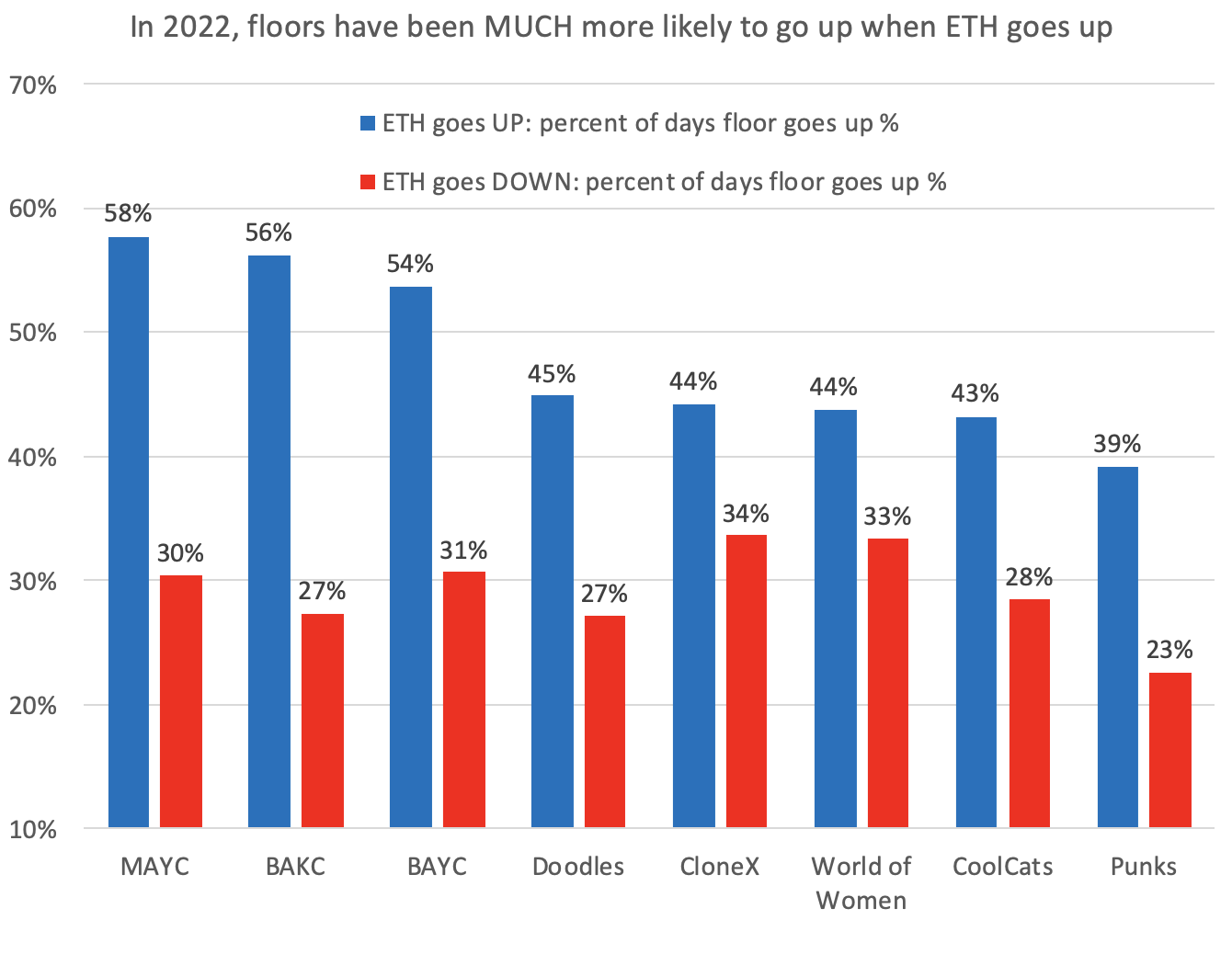

The STACKS Podcast recently explored the relationship between Ethereum and NFT floor price. Punk9059, a leading influencer and authority on NFT Twitter, joined the podcast to share his thoughts on the relationship between the second-largest cryptocurrency and NFT floor prices.

When Ethereum climbs, it has historically been a positive for NFT prices, though most investors price their digital art and collectibles in ETH. Punk9059 believes Ethereum price and NFT floor prices have a direct correlation.

Relationship between Ethereum and NFT floor prices

A decline in Ethereum price resulted in capital outflow from NFTs, as investors pulled cash out of volatile assets including jpegs. Therefore, higher Ethereum prices are the dream scenario for NFT holders as it drives floor prices higher.

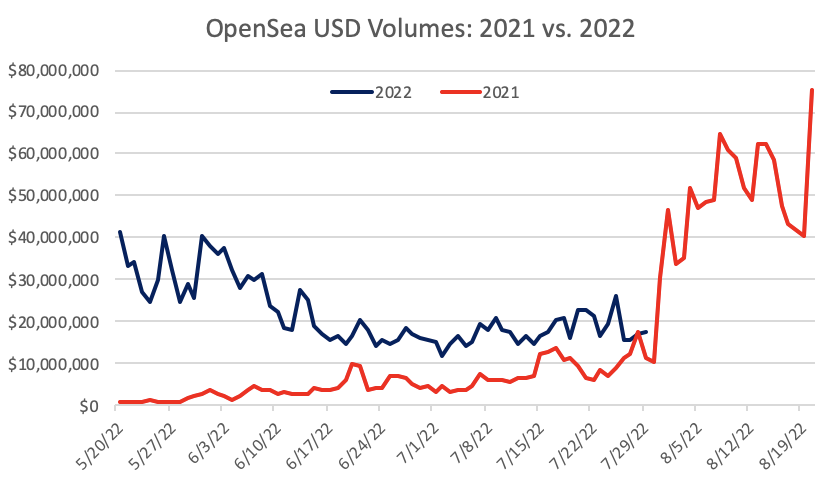

As of July 30, the monthly volume for NFT marketplaces is $626.11 million, a 41% decline from June 2022. An interesting insight is that July was the first month with more unique sellers than buyers. Unique buyer and seller wallets held up better than volumes.

July 30, 2022, marked the first time when NFT volumes declined year-on-year.

OpenSea USD Volumes: 2021 v. 2022

Ethereum’s dominant gas consumer, NFTs, is suffering a decline in trade volume. Checkmatey, a leading analyst, considers this a sign of declining demand. Therefore, the Ethereum price could drop in line with reduced demand.

NFTs are the dominant gas consumer on Ethereum and have been for a while.

This is low demand.

Cautious of prices folks, not seeing demand growth to support it. https://t.co/6EXZpCuyQZ

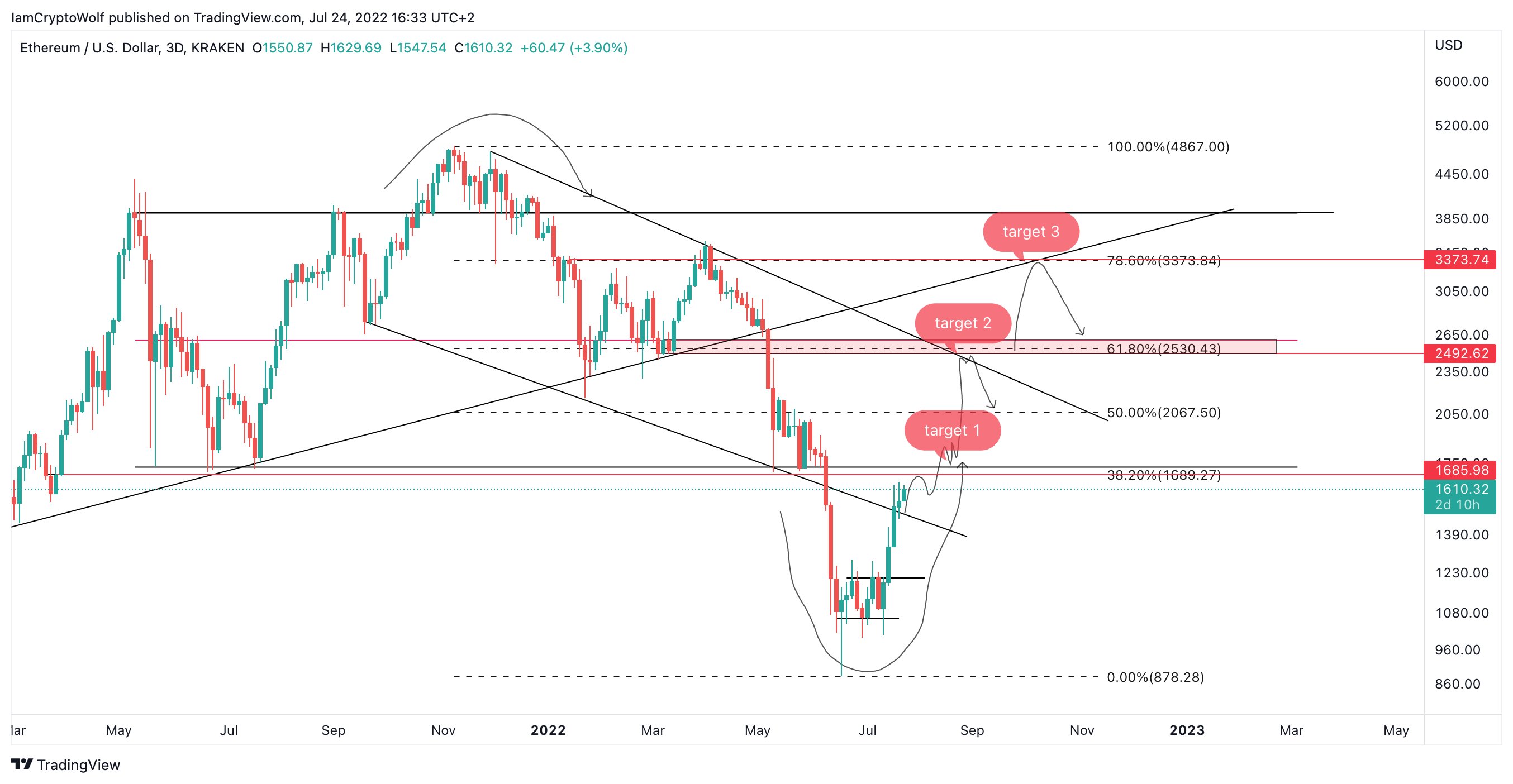

Wolf, a pseudonymous crypto analyst looks at Ethereum’s recovery that started on July 22, 2022, as a V-shaped one. The first target of $1,685 was hit, and the analyst’s next two targets for ETH are $2,492 and $3,373. The analyst argues Ethereum price pullback to $1,500 is warranted, given it completes the V-shaped recovery predicted in his roadmap for the altcoin.

ETH-USD price chart

Analysts at FXStreet meanwhile explore the possibility of Ethereum price decline to $300 in their recent video. For more information, check the video below:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price has been extremely bullish ever since July 26, when it kick-started a second bullish leg. Regardless, BTC is yet to face another hurdle that will determine if there are buyers with conviction behind the recent run-up or if it is built on weak-handed longs.

Ethereum price has done the unthinkable over the last 24 hours and flipped an important hurdle into a launching pad. All that’s left for ETH to do now is to maintain this momentum and rally to new hurdles.

Timothy Stebbing introduced a new tool in the Dogecoin community's arsenal to tackle Fear, Uncertainty and Doubt (FUD) about DOGE. The meme coin started recovering after the FOMC rate hike announcement and recouped its losses from the past two weeks.

Investors seem to be shifting their attention back to the cryptocurrency market following the Fed's Wednesday interest rate verdict, when it raised rates by 75 basis points, to combat rising inflation.

Bitcoin has overcome the 200-week SMA and 30-day EMA, denoting a major surge in bullish momentum. As a result, BTC could revisit anywhere from $25,000 to $30,000 soon. A daily candlestick close below 200 four-hour SMA at $21,117 will invalidate this bullish thesis.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.