BREAKING: Market Slides As Powell’s Comments Continue To Weigh On Investors

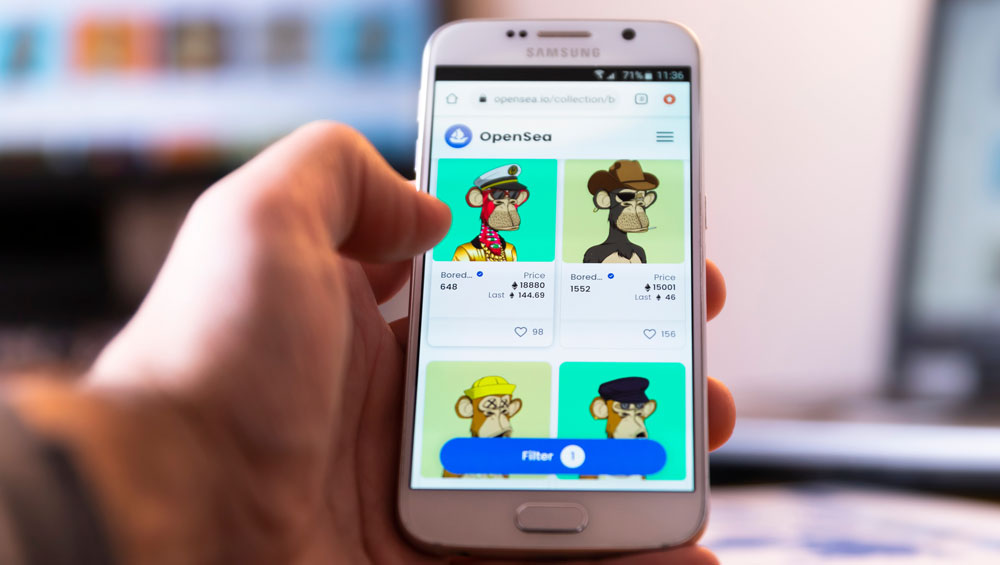

Millions of dollars of Bored Ape Yacht Club, CryptoPunks and CloneX NFTs risk liquidation as BendDAO faces a debt crisis. BendDAO is a peer-to-peer lending service that allows users to borrow Ethereum against their non-fungible tokens.

Loans — from BendDAO to NFT buyer — are typically 30% to 40% of a NFT collection’s floor price, or the minimum purchase price on the open market, and customers put up their NFTs as collateral. BendDAO calculates the health of the loan based on the floor price of an NFT collection and how much is still owed. If the floor price falls too close to the amount of the loan, it encroaches on a liquidation threshold and BendDAO will auction the NFT to recoup the debt.

BendDAO will automatically put collateralized NFTs up for auction if their “health factor” falls below 1.2, and could liquidate them completely if it falls below 1. In that scenario, borrowers have 48 hours to repay their loans or risk losing their NFTs. And it’s starting to play out.

The price of Bored Ape NFTs fell below 70 ETH in August from about 153 in May. Some crypto analysts estimate there are roughly $55 million worth of NFTs at risk of liquidation. Currently, there are dozens of Bored Apes, Mutant Apes and CloneX NFTs that have health factors under 1.2, according to BendDAO’s auction page. But a majority that defaulted have no bids. As things stand, borrowers will need to pay 100% interest on their loaned ETH. And BendDAO is deciding on changing its terms to incentivize bids and make it easier to sell the defaulted digital assets.

You can follow Harrison Miller for more stock news and updates on Twitter @IBD_Harrison

YOU MIGHT ALSO LIKE:

Cryptocurrency Prices and News

What Is Cryptocurrency?

Get Stock Lists, Stock Ratings And More With IBD Digital

Find Stocks To Buy And Watch With IBD Leaderboard

Identify Bases And Buy Points With MarketSmith Pattern Recognition

IBD’s third annual Most Trusted Financial Companies survey reveals the strength of previous winners and the vigor of newcomers. (© sisti/stock.adobe.com)

Get instant access to exclusive stock lists, expert market analysis and powerful tools with 2 months of IBD Digital for only $20!

Get market updates, educational videos, webinars, and stock analysis.

Learn how you can make more money with IBD’s investing tools, top-performing stock lists, and educational content.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the stocks they discuss. The information and content are subject to change without notice.

*Real-time prices by Nasdaq Last Sale. Realtime quote and/or trade prices are not sourced from all markets.

Ownership data provided by Refinitiv and Estimates data provided by FactSet.

© 2000-2022 Investor’s Business Daily, LLC. All rights reserved