![]() Ekta Mourya

Ekta Mourya

FXStreet

RippleX developers performed tests on the XRP Ledger to measure NFT throughput. Upwards of 71 million accounts minting 20 NFTs each were tested on the Ledger and the test was concluded successfully. Ripple’s side in the legal battle against the US regulator was strengthened by the addition of two new lawyers to the payment giant’s team.

Also read: Ripple does not stand a chance against SEC, affirms former securities regulator

RippleX developers conducted a myriad of tests on the ledger to identify the throughput for NFT transactions. In addition to 70.6 million accounts that exist on the ledger (based on the snapshot), one million new accounts were created.

The Ripple Ledger was tested for a total of 20 million NFTs, as offers and acceptance were recorded as transactions on the network. Ripple ledger sustained through the workload and offered a throughput rate of 751 per second. For XRP payments and NFT transaction pair, the throughput was relatively higher, 1,064 per second. For NFT mints, it was nearly half of the transactions, 384 per second.

The development arm of Ripple then concluded that they are confident in XRP Ledger’s ability to support the XLS-20 for NFTs.

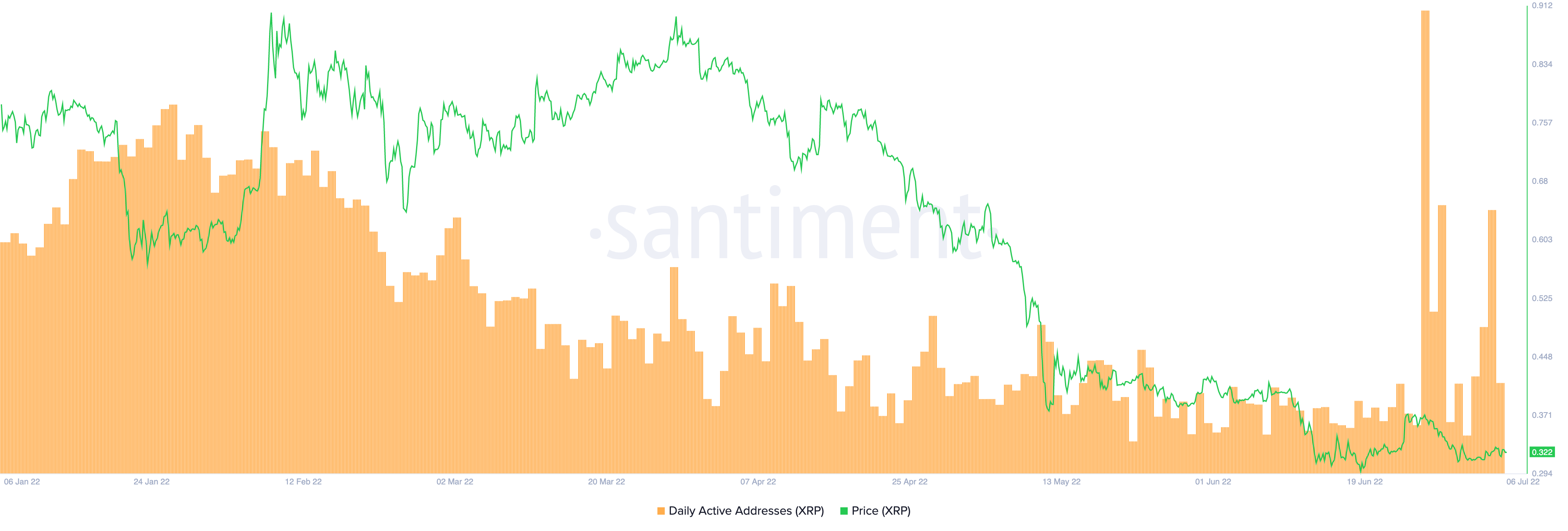

Analysts at the crypto intelligence firm Santiment noted that XRP held its ground better than most other altcoins in the crypto slide last week. Interestingly, the XRP network exploded with a spike in unique addresses. The number of unique addresses interacting on the altcoin’s blockchain crossed 200,000 for the first time since February 2020.

XRP hit the highest level of activity in terms of active addresses for the first time in over two and half years, offering key insight into the performance of Ripple against its altcoin competitors.

XRP daily active addresses

There is an exciting development in the US Securities and Exchange Commission’s (SEC) lawsuit against Ripple. The payment giant has added two new lawyers to the team to defend against the SEC’s charges of alleged illegal securities offering through the sale of XRP.

Kellogg Hansen lawyers Kylie Chiseul Kim and Clayton J. Masterman are the two new attorneys Ripple added to its team. Typically, the addition of the new attorneys suggests that legal proceedings may be extended, and the battle may continue to rage for longer than expected.

Analysts at FXStreet note that the XRP price has created a range extending from $0.28 to $0.38, and the altcoin is currently in a deep discount mode. Analysts recommend taking profits at $0.38, identifying a demand zone that could prevent the XRP price from dropping lower. For more information and price targets, check out this video:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Polygon’s MATIC price continues to display optimistic signals. Being an early bull is justifiable as the invalidation level is clear. Matic price could rally towards $1.00 in the coming days. From Jun 18 to 24, the bulls accomplished a 90% rally.

Tezos price has seen an 83% decline since the all-time highs at $9.14 back in October 2021. The bearish strength is prevalent within the technicals, as the bulls have been unable to retrace at least 50% of each subsequent decline.

Terra's LUNA price shows concerning signals, with bears targeting $1.00. Still, being an early seller is ill-advised. Terra's LUNA price sideways action is finally starting to make sense.

Bitcoin price coils in a sideways triangular trading range. Goldman Sachs rumored to have opened their first BTC futures and options position. Invalidation of the bearish downtrend is a break and close above $21,868.

Bitcoin price ended Q2 with a -56% return, which is the first in its 11-year history. On-chain metrics hint at bottom formation but technicals reveal more room to the downside. Bitcoin price has finished the first half of 2022 and things are not looking good. With record negative returns, BTC is likely to continue heading lower, especially if one particular support level is breached.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.