![]() Aaryamann Shrivastava

Aaryamann Shrivastava

FXStreet

The crypto market faced its first major cyber attack of the year in the form of a social media hack impacting Robinhood and NFT project Azuki. While the damage was not as severe as social media channel attacks in the past have seen, it did bring back the question of cyber crime awareness as the hack was in the form of phishing.

Robinhood and Azuki became the recipient of a hack wherein the intruder managed to gain control over the Twitter accounts of the trading platform and the NFT project. The hacker began posting phishing links on the accounts not too long after also hacking the Discord of Azuki, where the damage was far more severe.

According to reports, the Azuki attack resulted in the attacker phishing away with about 122 NFTs, estimated to be worth around $778,408. This 484.99 ETH hack was achieved through a specific phishing mode wherein signature pending orders were induced through Seaport. While the assortment of NFTs stolen is yet to be confirmed, the 122 NFTs seemed to include 2 Mutant Ape Yacht Club NFTs as well.

Azuki regained control of its Twitter channels soon after and confirmed the attack by tweeting,

“We immediately reached out to our contacts at Twitter, as well as took steps to alert the community. The malicious tweets and links were taken down swiftly. Our investigation into the Twitter breach is ongoing. We take security seriously, and the Twitter account was secured using a 2FA Authentication app.”

On the other hand, no reports of damage taken by Robinhood users have surfaced yet, neither has the trading platform made any statement regarding the same.

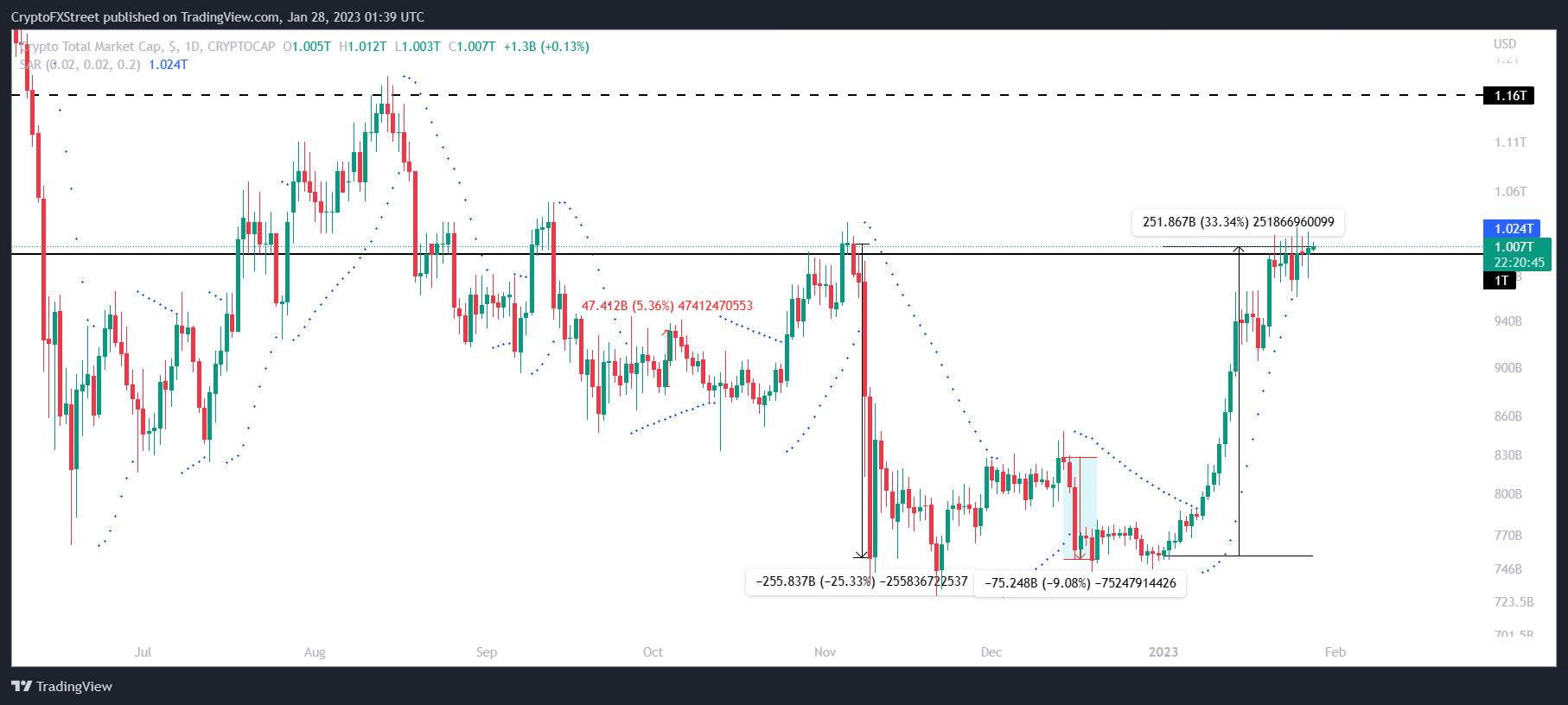

Two months after facing the FTX collapse-induced crash, the total crypto market capitalization finally recovered its losses as the value of all the cryptocurrencies crossed the $1 trillion mark.

Total crypto market capitalization

Year to date, the crypto market capitalization rose by 33.34%, rising by $251 billion to touch $1.006 trillion. However, Bitcoin and Ethereum prices did not note any significant jump in the last 24 hours, except for the king coin rising above $23,000 and the second-generation cryptocurrency slipping below $1,600.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price shows a lack of momentum after an explosive move in the last three weeks. The fourth week has been relatively silent, without a lot of volatile moves.

Ethereum Classic (ETC) saw the headwinds that triggered the massive sell-off of 2022 fade a bit to the background in the first weeks of 2023. That resulted in bulls returning to life after a hibernation of almost five consecutive straight months.

Ripple, the cross-border remittance giant is likely to win its legal battle against US financial regulator, the Securities and Exchange Commission (SEC) according to crypto proponent John Deaton.

Shiba Inu holders who acquired SHIB more than 11 months ago are holding onto their tokens. These holders have refrained from selling their SHIB holdings since December 2021.

Bitcoin price shows a lack of momentum after an explosive move in the last three weeks. The fourth week has been relatively silent, without a lot of volatile moves. While BTC consolidates, other altcoins are rallying left and right, providing massive gains.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.